- John Goodman

- Larry Kotlikoff

- Jane Shaw Stroup

- Thomas Saving

- Devon Herrick

- Linda Gorman

- Pete Du Pont

- All Posts

Fact Checking the Two Presidents

Although news articles often call Donald Trump a “liar,” I don’t think I have ever seen that term used when discussing Joe Biden. Following the first presidential debate, fact-checkers at the New York Times and the Wall Street Journal accused Trump of numerous falsehoods. But they couldn’t find a single Biden falsehood. With respect to Trump, they can’t see the forest for the trees. With respect to Biden, they can’t see the trees. More.

Why We Hate Each Other

When we were polarized in the past, there were arguments and (sometimes not so civil) debates over a major public policy issue. What are the major public policy issues that are dividing us today? I suggest that there aren’t any. What is driving a wedge between us today is tribalism – not government policy. More.

Common Sense as Health Policy

America is thought to have a market economy. Yet it is striking to consider all of the ways our health-care system prevents the market from solving our health-care problems.

Since most of the restrictions were created by Democratic legislation, it is tempting to view the liberation of health care as a Republican project. But there is no reason that it couldn’t be bipartisan. Here are several principles to guide reform.

The Inflation Tax

With 10% inflation, the average family can expect to lose 7% of its lifetime income to government.

This is the startling conclusion of a first-ever study by Laurance Kotlikoff and Alan Auerbach and their colleagues. The sources of the loss: (1) large parts of the tax code are not inflation indexed, (2) those parts that are indexed are indexed with a lag, and (3) Social Security benefits and other entitlements are also indexed with a lag. Our fiscal system is so incredibly complex that it has been impossible to measure the overall effects of inflation before now. Given the 20 largest federal/state entitlements, all administered differently by 50 states, that gives us 1,000 fiscal systems– to say nothing of all the different tax regimes. Hats off to the economists who spent several years developing the model that could give us a reliable answer. See John Goodman’s explanation of the study at Forbes.

Do You Trust your Health Insurer?

Why do employers (including government employers) and insurers mistreat enrollees with costly health care problems? When the New York Times describes the abuses, you are encouraged to believe that the blame rests with private insurance. In fact, the source of the problem is perverse incentives created by bad government policies. More.

Medicare Spending Forecast

Bad as the Trustees Report is, the reality is likely to be ever worse.

Source: James Capretta, AEI

Identity Politics Explained

Racism is the lowest form of collectivism. Ayn Rand once called it “barnyard collectivism.” Throughout history, it has usually been the handmaiden of every other form of collectivism. In the modern world, collectivists are no longer able to make a serious argument for economic collectivism (socialism, fascism, communism, etc.) So, they have resorted to identity politics instead. More.

What Does the Left Have Against Au Pairs?

Au pairs represent a potential solution to two huge problems: the high cost of child care and the high cost of elder care. Young European women get free room and board, some spending money and a chance to experience America. So why does the Biden administration want to price them out of the market? More.

Reason for Our Health Care Crisis: Government

Michael Cannon argues that all of our major health care programs (Medicare, Medicaid, Obamacare, etc.) came into existence primarily to solve problems created by previous government interventions. And, the reason why there is a continuing push for further reform is because all the programs that are supposed to be solving problems are creating new ones. More.

Why We Hate Each Other, Part II

The vast bulk of people who are writing and evaluating health care programs reveal a bias based on which party designed the program, not on how well it works relative to other programs. The biggest problem with tribalism is this: It is in the self-interest of politicians to come up with new solutions to persistent problems; but once an idea is proposed, the knee-jerk reaction is for everyone in the other party to dismiss it– no matter how good the idea is. More

Matt Yglesias Discovers Public Choice

He writes: “If you want to understand the economic policies that wrecked Argentina . . . . What started as a little effort at protectionism and industrial policy sprawled over the years into a vast web of clientelism and patronage, where political connections determined who could do business and on what terms.” Here is what’s missing: In the United States, tax law, labor law, employee benefits law, environmental regulation, public school finance and even the Defense Department budget – all of these areas suffer from the same special-interest push-and-pull that have plagued Argentina. More.

The Government’s New Tax Break for Retirees is Less Than Meets the Eye

QLACs — Qualified Longevity Annuity Contracts promise to be “A Retirement Tax Break That Ends the Fear of Outliving Your 401(k).” But while buying a QLAC lowers the person’s exposure to one major risk (living too long), it raises exposure to another risk: inflation. More

What the Debt Deal Ignored

A month ago, Social Security’s Trustees published their annual report. Table VIF1, buried deep in the Appendix, where no one looks, is the statement that Social Security’s unfunded liability is $66 trillion. This measure of Social Security’s red ink is not just gargantuan on its own. It’s $13 trillion larger than it was just three years ago. More

Social Security Sues invalid for Money He Received 21 Years Ago, At Age 11

Roy Farmer of Grand Rapids Michigan has Cerebral Palsy. He’s 32. In 2019, out of the blue, he received a claw back letter from Social Security demanding he repay $4,902 that his (now deceased) mother received back when he was 11. Roy has spent over three years appealing this judgement. He’s been denied twice. More from Kotlikoff Forbes editorial.

Our Fiscal System Needs Reform

Over half of working-age Americans face lifetime marginal tax rates (including direct taxes and loss of entitlement benefits) above 43 percent. One in ten in the bottom fifth face tax rates above 70 percent, effectively locking them into poverty. For some would-be-workers, the tax rates exceed 100 percent.

Extremely high LMTRs reflect the complete loss of family benefits, in the current and future years, from programs such as Medicaid – which ends benefits abruptly if one’s income or assets exceed specific thresholds by even one dollar. More.

Social Security’s Massive Malfeasance

Social Security has committed and continues to commit huge fraud against 13,000 plus widow(er)s who collectively have been swindled out of $130 million. Those are the figures of Social Security’s own Inspector General. More

America’s Fiscal Gap

That’s the difference between the federal government’s spending commitments and its income – looking indefinitely into the future. Closing the gap through time requires an immediate and permanent 41.3 percent increase in all federal taxes or an immediate and permanent 35.3 percent cut in all non interest federal spending. More

Social Security Benefits: Heads They Win, Tails You Lose

One disabled lady was clawed back for over $300,000 for a mistake that Social Security admitted in writing was theirs! If she doesn’t repay, Social Security will almost always stop sending people like her a single penny until they pay “what they owe.” This can take years or decades. More

House Republicans – Raise the Debt Limit, But Stick to Your Fiscal Guns. Our Country Is Dead Broke!

Our country’s fiscal gap is 7.7 percent of GDP. This means we need to collect 7.7 percent more in taxes, every year starting now, to cover all the future spending the CBO projects. Alternatively, we need to immediately and permanently lower the path of federal spending by 7.7 percent of each future year’s GDP. Or we can do neither of these things and dig an even deeper hole for our kids. More

Social Security Claws Backs $34K from a Disabled Blind Worker for “Overpayments” Going Back 23 Years!

Social Security sends out more than 2 million clawback letters every year. Why so many clawbacks? Simple. Social Security doesn’t have the data it needs to correctly calculate benefits for tens of millions of us. Or it has the information on day 1, but doesn’t process it. Or it inputs the wrong information. Or it mixes up your earnings record with someone else’s. Or it makes the wrong benefit calculations. I’ve seen all of this and more. More

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Letter to the Commissioner

Congratulations on limiting the amount by which a beneficiaries benefits may be clawed back because of Social Security ‘s own mistakes. More needs to be done however. More.

Julian Simon, Vindicated Again

Each year, the Competitive Enterprise Institute (CEI) has a dinner in Washington, D.C., honoring the economist Julian Simon, who died in 1998. Simon was a rare optimist in the fields of population and natural resources. He disagreed with most environmentalists of his day (especially in the 1980s through 1990s). They feared passionately that growing population would overwhelm agriculture and industry and that the world would run out of natural resources such as oil and minerals.

The “Madness of Crowds”?

Can history help us understand today’s panic over global warming? While the Earth is warming and human activity is probably contributing to it, the overheated efforts to make people fear the long-term future suggest that this is more of a crusade than a rationally considered enterprise. Extreme fear of global warming is negatively affecting politics, the economy, the media, international relations, and education.

Economic Growth Theories Fall into the Dustbin of History (And That’s Okay)

Economists like Samuelson failed to understand economic growth in developing countries. Unbeknownst to them, cost-reducing innovations in transportation and communication led to increased trade and lifted people out of poverty. The Industrial Revolution benefited only a small portion of the world. Trade spurred prosperity and development on its own.

Conservation Leases?

This guest post by Shawn Regan is a substantive analysis of the recent proposal by the Interior Department's Bureau of Land Management to allow leasing of public land for conservation purposes. Regan is vice president of research at the Property and Environment...

Can There Be Too Many Trees?

Drought-resistant trees are replacing grasslands around the world, and, specifically in the western United States. This is a problem? More.

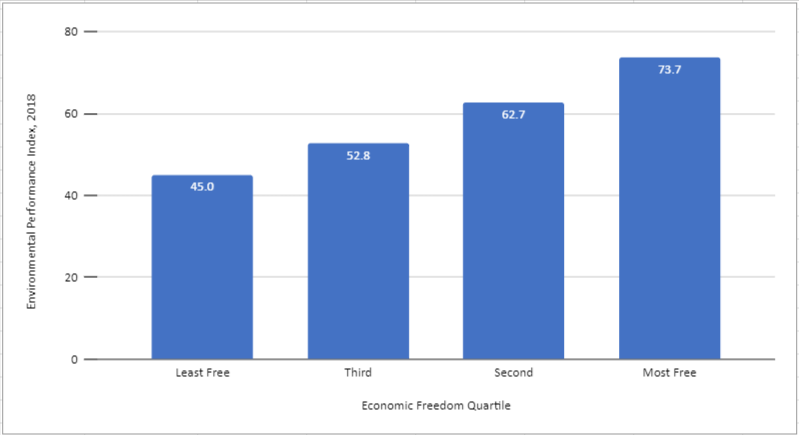

Economic Freedom IS good for the environment

Yes, data from the Yale Center for Environmental Law & Policy and the Fraser Institute’s Economic Freedom of the World Index send a resounding message: Economic freedom brings about environmental protection. Why? Because economic freedom leads to prosperity and only prosperous countries can truly protect their environment. Are you skeptical? More.

Why California Needs Higher Prices for Water

California’s extreme drought will force rationing of water or higher prices, say John McKenzie and Richard McKenzie. Raising water prices has a great advantage: “Higher water prices can increase the state’s available water supply—without additional rainfall or...

Should We Even Try to Recycle Plastics?

Pressuring plastic producers to recycle their products has gone on for decades. But two writers at the Atlantic have now concluded, “Plastic recycling does not work and will never work.” In the U.S. in 2021 only 5 percent of all post-consumer plastic was recycled. Furthermore, they say that the plastic producers deny this and those denials are “reminiscent of” the tobacco companies in making false claims. (For years, many tobacco firms rejected the idea that cigarettes caused cancer.)

Charlotte Hawkins Brown: Education under Difficulties

The year 1901 was not a promising time for Charlotte Hawkins Brown, a young black woman, to return to her native North Carolina and teach in a mission school. White supremacists had overthrown North Carolina’s Fusionist government in 1900. The new governor was proud of the amendment to the state constitution that had “the deliberate purpose of depriving the negro of the right to vote, and of allowing every white man to retain that right.” Schools were separate and unequal in spite of the 1896 Supreme Court decision that said they could be separate if they were equal.

More Important Than the Industrial Revolution

It’s called the Transportation-Communication Revolution. In recent times, shipping costs have fallen by 50 percent and air cargo costs have fallen by almost 100 percent. As a result, the per capita GDP of developing countries (outside of sub-Saharan Africa) between 1960 and 2015 rose a whopping 549 percent.

Dueling: A Gentleman’s Duty or a Nasty Habit?

A recent scholarly paper perused two newspapers (the New York Times and the Richmond Daily Dispatch) for duels reported between 1861 and 1865. They found 130 duels (over just five years!). Of these 130 duels, they write, “71 involve prominent figures, which we define as politicians, military officers with rank of at least colonel (Army) or captain (Navy), and other well-known private citizens.”[2]

Read the original article (and view the notes) on janetakesonhistory.org

Goodman and Saving: Budget Deal’s Trillion Dollar Surprise

The most significant federal entitlement reform in our lifetime was a little noticed provision that Democrats included in the Affordable Care Act. The provision was a cap on Medicare spending, similar to the cap Republicans proposed for Medicaid last summer.

Saving on CNBC: FED is holding 20% of federal debt

The Federal Reserve System is holding 20% of the federal government’s publicly held debt. It also is holding a lot of bank reserves. For every dollar of required reserves, banks have deposited $12 at the FED.

Gramm and Saving in the Wall Street Journal: Fed Task is Precarious

The Fed balance sheet contains 20% of all publicly held federal debt and 34% of the value of all outstanding government-guaranteed mortgage-backed securities. As the economy returns to normal growth, getting rid of those assets risks runaway inflation or a crippled recovery or both.

Saving: Are Republicans Too Stingy with Medicaid?

Before the Senate voted on a “skinny” alternative to Obamacare, it was considering the House version of repeal and replace – called the Better Care Reconciliation Act (BCRA).

The Federal Reserve’s Accountability Deficit

The Federal Reserve enjoys extraordinary independence from the elected branches of government, based on the well-founded fear that politicians cannot be trusted with the power to print money and manipulate interest rates.

Tom Saving has a new book

Tom Saving has a new book called A Century of Federal Reserve Monetary Policy: Issues and Implications for the Future.

Saving and Gramm in the Wall Street Journal: The Fed’s Obama-Era Hangover

The Federal Reserve System is paying banks not to lend money under an Obama era policy.

Gramm and Saving in the WSJ: The Fed has lost its ability to control interest rates

Writing in the Wall Street Journal, former Sen. Phil Gramm and Goodman institute Senior Fellow Thomas Saving write “Never in the Fed’s 105-year history has it had less control over market interest rates than it has today…. To expect the Fed to hold interest rates above or below the market rate under these circumstances is not only naive but dangerous.”

Health Reform: There Is Something for Everyone to Love… and Hate

Why is it controversial to expand the physician supply, creating more competition? Doctors oppose it, just like they oppose expanding the scope of practice for nurse practitioners. Doctors don’t want me to be able to see a nurse practitioner or physician assistant for a wart on my toe unless that NP/PA works for them.

How did doctors get so powerful? In the first half of the 20th Century, the American Medical Association (AMA) waged a largely successful battle to close medical schools that trained competing physicians. …. More than half of American and Canadian medical schools were closed…. Thus, the job of a physician was yanked out of reach of all but the smartest, most disciplined, wealthy elites.

The 60 Percent Solution to Reforming Healthcare

Can we transform the entire health care system by empowering the roughly 60 percent of patients who are in private health plans? That’s the premise of a new book I just read by Todd Furniss (@TFurniss on Twitter). The author ofThe 60% Solution: Rethinking Healthcare, believes there are five major reforms necessary to empower patients and help them get better care at better prices. These include: (1) change governance, (2) modify health savings accounts (HSAs), (3) clear prices, (4) standardize accounting and information technology in the medical industry and (5) emphasize primary care.

Herrick: OBAMACARE RATIONS CARE FOR THE SICK AND OVERCHARGES THE HEALTHY

The health care reform debate that lead to Obamacare was initially about covering the uninsured, but in order to gain the support of ordinary people who already had coverage, proponents had to figure out a way to sway public opinion.

Herrick: States Should Ban These Lab Scams

There is a new health care scam spreading across rural America that could cost you plenty. Large commercial labs like Quest Diagnostics and LabCorp do not have locations in every small town. As a result, many rural hospitals perform lab work for both their inpatients and outpatients in the local community.

Herrick: Future Pandemics Require Better Access to Primary Care

When Americans become ill or have a health complaint, they often schedule an appointment with a primary care provider (PCP). PCPs are often the first line of defense in the battle against the onset of seasonal outbreaks of colds, flu or more serious problems like COVID-19.

Herrick: Could Free-Market Medicine Respond Better to Pandemics?

Many people have come to believe that the only way to protect Americans against future pandemics is to turn over control of our health care system to the government. The folly of this view was apparent when the U.S. Centers for Disease Control & Prevention (CDC) utterly failed as the monopoly supplier of COVID-19 diagnostic testing kits. When the first cases appeared, about half of the test kits failed and replacements were slow in coming.

How Obamacare Made Things Worse for Patients With Preexisting Conditions

One of the strange features of the national health care conversation is how it has evolved. What is often referred to as Obamacare began as an attempt to insure the uninsured. In fact, the initial Congressional Budget Office estimates predicted the Affordable Care Act would be largely successful in doing just that. Yet it was the Senate’s Democratic leader, Chuck Schumer of New York, who identified the political problem with that goal early on. About 95% of those who vote already have insurance, Schumer noted. So Obamacare was promising to spend a great deal of money on people who don’t vote.

Response to Coronavirus Reflects Trump’s Plan to Radically Reform Health Care

Critics of President Trump’s response to the coronavirus crisis characterize it as knee-jerk, spur-of-the-moment, and grasping at any straw within reach. In fact, many of the executive actions we have seen in the past few days reflect a new approach to health policy that has been underway almost since the day Donald Trump was sworn into office.

What’s Behind the Vaccine Slowdown?

What’s behind the slowdown in vaccinations? The consensus among experts is those not yet vaccinated either 1) don’t want the vaccine 2) harbor some doubts about vaccine safety or efficacy, or 3) simply lack the motivation to find vaccine providers and make an appointment. Vaccine hesitancy accounts for about one-third of adults. For example, the Kaiser Family Foundation ran a survey in April that found 15 percent of respondents who had not received the vaccine plan to “wait and see.” Another 6 percent will get vaccinated “only if required,” and 13 percent refuse to get the vaccine.

Correcting Misconceptions of Health Care Reform

One reader posed the question, how does the tax break for employee health insurance harm our health care system? Short answer: over time the practice reduced competition, which weakened cost-control and resulted in health care inflation three times that of consumer inflation. Consider this: once covered by generous health plans, workers cared less about what medical care cost because their health plans paid most of the tab. Employers didn’t care what things cost because they were passing on the costs to workers (indirectly) in lieu of higher cash wages. Third party administrators (TPAs), who manage the benefits for employers, didn’t much care what things cost because they were passing on the costs to employers with a mark-up. The more money spent, the more TPAs earn.

How a Questionable Drug Turned into a Goldmine at Taxpayers’ Expense

On June 7th the U.S. Food and Drug Administration approved a new drug to treat early-stage Alzheimer’s disease. Is this good news for patients suffering with Alzheimer’s disease? Probably not and certainly not for taxpayers. The clinical trial data found little evidence the drug works. One Phase 3 clinical trial showed a slight slowing in cognitive decline, while the second clinical trial failed to show any improvement.

The $3.5T Spending Mistake

Congressional Democrats are proposing to spend an enormous amount of taxpayer dollars on what the New York Times calls a “cradle to the grave” addition to U.S. social welfare. When budgeting shenanigans are ignored, the Committee for a Responsible Federal Budget estimates that the full cost is not the $3.5 trillion that has been widely advertised, but at least $5.0 trillion and possibly as much as $5.5 trillion.

Gorman: US Hospitals are Safer

A frequent criticism of US hospitals is the charge of excessive adverse medical events, sometimes leading to avoidable deaths. How do our hospitals compare to hospitals in national health care systems? Quite well. The percent of patients who experience an adverse event is twice as high in Canada, three times as high in Britain and four times as high in New Zealand.

If The Court Strikes Down Obamacare, How Bad Would That Be?

This article was coauthored by Linda Gorman, director of health care at the Independence Institute in Denver, Colorado.

Gorman in The Hill: Trump’s Drug Plan Wrong Rx

The Trump administration wants to use an average of the drug prices paid by other countries to limit what Medicare Part B pays for some drugs. This is a bad idea.

Linda Gorman Study: Obamacare Dollars Wasted

The percent of the population with private health insurance actually declined during the eight years of the Obama presidency, according to a study by health economist Linda Gorman.

Gorman: Obamacare has been extremely wasteful

The federal government spent $341 billion from 2014 through 2016 on subsidizing individual coverage so that people would buy it (Not counting the money spent on state and federal exchanges).

Gorman in The Hill: Doctor Incentives Rx is Failing

The Medicare Payment Advisory Commission has voted to recommend scrapping the Merit-Based Incentive Payment System because it “cannot succeed.”

Gorman in Forbes: Will Tax Reform Kill People?

You know you are in the silly season when the charges against sensible tax reform become more and more outrageous. The silliest and most outrageous is based on this causal reasoning: The Republican tax measure repeals the Obamacare mandate, requiring people to purchase health insurance; without the mandate, fewer people will insure; and without insurance, more people will die.

Against Medicaid Expansion

Expanding Medicaid to the relatively healthy might make sense if it improved general health. But there is little evidence it does. In Oregon, for example, a first-of-its-kind controlled trial tracked individuals who applied for Medicaid through a lottery. After two years, there was no discernible difference in the physical health of the winners and losers. More

Hidden Traps in the IRA Bill’s Drug Provisions

In the near future, the elderly and the disabled will face a double whammy: higher premiums for Part D drug insurance and higher prices at the pharmacy. This is on top of negotiated prices (and the consequent drop in new drug production) which will kick in later in the decade.

John Goodman and Linda Gorman explain why this will happen in The Hill.

Leftists in Colorado Seem Poised to Try Again for Single Payer Health Insurance

Last time around, the idea was rejected by almost 79% of the voters. And for good reasons. British Columbia’s single payer system is so mismanaged it pays for cancer patient radiation treatments in Bellingham, Washington. Its hip replacement wait can be almost a year… Because Canadian patients wait twice as long as recommended for MRI scans, those who can afford it pay cash for quick service at US imaging centers in border cities like Buffalo, NY and Bellevue, WA. More.

Our Gravest Peril

ObamaCare? Stagnant economy? Crushing debt? Foreign policy fecklessness may trump them all. Commentary by Pete du Pont January 21, 2014 Source: Wall Street Journal America's most worrisome problem may not be the failed takeover of our healthcare system. It may not be...

The Great Destroyer

ObamaCare wreaks havoc on health care, the economy, American freedom and Obama's presidency. Commentary by Pete du Pont November 25, 2013 Source:The Wall Street Journal Polls show an increasing majority of Americans dislike President Obama's healthcare law and...

Hillary Will Run

How could she not? Commentary by Pete du Pont October 29, 2013 Source: Wall Street Journal Hillary Clinton is going to run for president in 2016. Granted, she is exhibiting even more coyness than most presidential prospects, and yes, the media are filled with those...

The Beltway Stalemate

Democrats and Republicans have never had such a conflict of visions. Commentary by Pete du Pont September 26, 2013 Source: The Wall Street Journal The debate about military action in Syria seems over for now, and Washington is back in campaign mode. We have a...

Obama’s Foreign Failure

The world hasn't lived up to his Pollyannaish expectations. Commentary by Pete du Pont August 27, 2013 Source: The Wall Street Journal Barack Obama entered the White House with the promise of restoring our nation's standing in the world. Suffering from war fatigue and...

Second-Term Nightmare

ObamaCare's chickens come home to roost. Commentary by Pete du Pont July 27, 2013 Source: The Wall Street Journal Talk about being between a rock and a hard place. The Obama administration and its allies in Congress are faced with the challenge of trying to convince...

Obama’s Anti-Energy Agenda

He threatens to cut off the fuel the economy needs. Commentary by Pete du Pont July 01, 2013 Source: The Wall Street Journal Not surprisingly, President Obama and Speaker John Boehner have different views on energy policy, differences brought into stark contrast by...

Obama’s Scandalous Legacy

He has given Americans new reason to distrust the government. Commentary by Pete du Pont May 28, 2013 Source: The Wall Street Journal It's too early to tell if May will be remembered as marking the beginning of a failed second term for President Obama, but it is clear...

The Left’s “Wars”

The Left’s “Wars” Commentary by Pete du Pont March 28, 2014 Source: The Wall Street Journal The midterm elections are just over seven months away and the left has unleashed its usual rhetoric about the Republican "war on women." It's baseless political pandering of...

Global Warming Heats Up

The public could use an honest debate. Commentary by Pete du Pont February 27, 2014 Source: The Wall Street Journal Global warming is back. Not actual global warming, as the decadelong trend of little to no increase in temperatures continues. But the topic of global...

The Real Inequality Problem

It isn’t that some people are wealthy but that others are struggling. Commentary by Pete du Pont April 28, 2014 Source: The Wall Street Journal Among the too numerous frustrations of the political process is that a lot of smart and talented people spend their time and...

Fact Checking the Two Presidents

Although news articles often call Donald Trump a “liar,” I don’t think I have ever seen that term used when discussing Joe Biden. Following the first presidential debate, fact-checkers at the New York Times and the Wall Street Journal accused Trump of numerous falsehoods. But they couldn’t find a single Biden falsehood. With respect to Trump, they can’t see the forest for the trees. With respect to Biden, they can’t see the trees. More.

Why We Hate Each Other

When we were polarized in the past, there were arguments and (sometimes not so civil) debates over a major public policy issue. What are the major public policy issues that are dividing us today? I suggest that there aren’t any. What is driving a wedge between us today is tribalism – not government policy. More.

Riots over the Bible? Yes. In Philadelphia.

When we think of conflicts between Catholics and Protestants, we think of the wars following the Protestant Reformation in Europe in the 1500s and 1600s. The United States, we assume, has followed a policy of free expression of religion, as promised in the First Amendment to the U.S. Constitution. Sad to say, that is not true. I would like to share with you (briefly) the story of the “Philadelphia Riots of 1844.”

Inflation is a Hidden Tax

A new study lays out the toll of lifelong high inflation on consumers. It estimates that permanent 5% inflation would lower household lifetime spending by 3.62%. Permanent 10% inflation would lower lifetime household spending by 6.82%. Even if inflation ran permanently at the Fed’s 2% target, consumers would still feel a pinch, with a 1.5% reduction in lifetime household spending. More.

Common Sense as Health Policy

America is thought to have a market economy. Yet it is striking to consider all of the ways our health-care system prevents the market from solving our health-care problems.

Since most of the restrictions were created by Democratic legislation, it is tempting to view the liberation of health care as a Republican project. But there is no reason that it couldn’t be bipartisan. Here are several principles to guide reform.

The Inflation Tax

With 10% inflation, the average family can expect to lose 7% of its lifetime income to government.

This is the startling conclusion of a first-ever study by Laurance Kotlikoff and Alan Auerbach and their colleagues. The sources of the loss: (1) large parts of the tax code are not inflation indexed, (2) those parts that are indexed are indexed with a lag, and (3) Social Security benefits and other entitlements are also indexed with a lag. Our fiscal system is so incredibly complex that it has been impossible to measure the overall effects of inflation before now. Given the 20 largest federal/state entitlements, all administered differently by 50 states, that gives us 1,000 fiscal systems– to say nothing of all the different tax regimes. Hats off to the economists who spent several years developing the model that could give us a reliable answer. See John Goodman’s explanation of the study at Forbes.

Do You Trust your Health Insurer?

Why do employers (including government employers) and insurers mistreat enrollees with costly health care problems? When the New York Times describes the abuses, you are encouraged to believe that the blame rests with private insurance. In fact, the source of the problem is perverse incentives created by bad government policies. More.

Letter to the Commissioner

Congratulations on limiting the amount by which a beneficiaries benefits may be clawed back because of Social Security ‘s own mistakes. More needs to be done however. More.

Reason for Our Health Care Crisis: Government

Michael Cannon argues that all of our major health care programs (Medicare, Medicaid, Obamacare, etc.) came into existence primarily to solve problems created by previous government interventions. And, the reason why there is a continuing push for further reform is because all the programs that are supposed to be solving problems are creating new ones. More.

Why We Hate Each Other, Part II

The vast bulk of people who are writing and evaluating health care programs reveal a bias based on which party designed the program, not on how well it works relative to other programs. The biggest problem with tribalism is this: It is in the self-interest of politicians to come up with new solutions to persistent problems; but once an idea is proposed, the knee-jerk reaction is for everyone in the other party to dismiss it– no matter how good the idea is. More

Matt Yglesias Discovers Public Choice

He writes: “If you want to understand the economic policies that wrecked Argentina . . . . What started as a little effort at protectionism and industrial policy sprawled over the years into a vast web of clientelism and patronage, where political connections determined who could do business and on what terms.” Here is what’s missing: In the United States, tax law, labor law, employee benefits law, environmental regulation, public school finance and even the Defense Department budget – all of these areas suffer from the same special-interest push-and-pull that have plagued Argentina. More.