Sen. Phil Gramm (video)

Debater Resources

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.Dr. Goodman’s interest in speech and debate has never waned and he is excited to share some in-depth thoughts and ideas on current debate topics.

Resolved:

The United States federal government should substantially increase fiscal redistribution in the United States by adopting a federal jobs guarantee, expanding Social Security, and/or providing a basic income.

Major Update: Relationship Between Inequality, Economic Systems and Growth

10 Pages

For High School Debate on Inequality

General Topic Review

18 Pages

General Analysis for High School Debate on Inequality

Ideas for the Affirmative

Arguments for the Negative

Articles on Economic Inequality

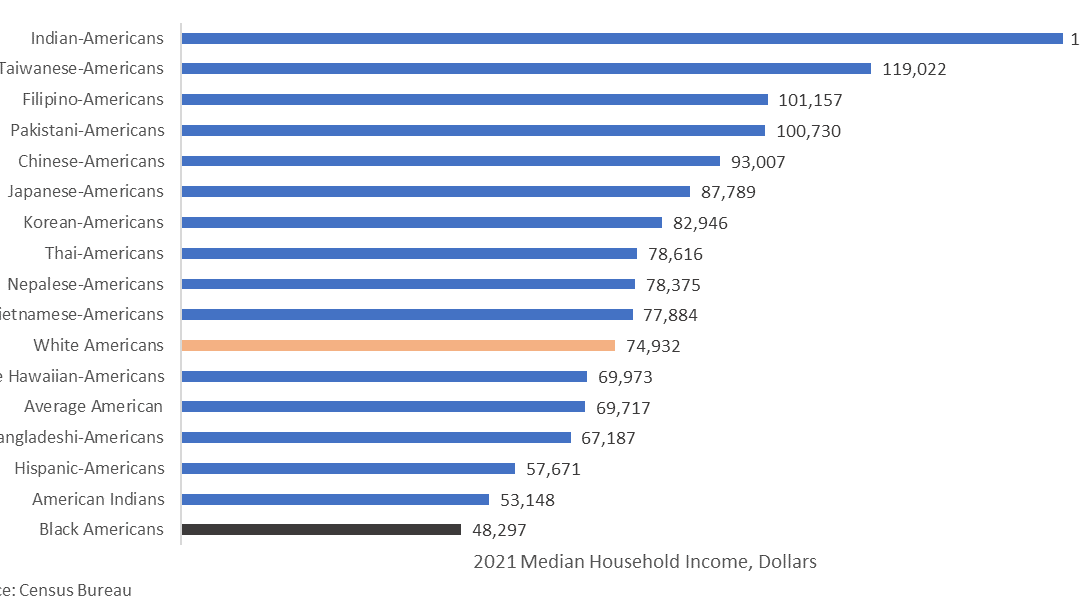

Average Household Income by Race, Ethnicity

The latest Census data is out on income levels by ethnicity. The good news is that the latest data flatly contradict the left’s narrative that America is “systematically racist.” As the chart below shows, by far the most affluent group is NOT whites, but Asians.

View the article on the Committee To Unleash Prosperity’s website.