- John Goodman

- Larry Kotlikoff

- Jane Shaw Stroup

- Thomas Saving

- Devon Herrick

- Linda Gorman

- Pete Du Pont

- All Posts

Biden v. Medicare Advantage

When does the failure to answer a phone call in 8 seconds cost the company receiving the call $190 million? When the caller is a spy working for the agency that runs Medicare and the receiving entity is a private insurance company. More.

Two Cheers for the Bipartisan Tax Deal

A rare bipartisan agreement in Congress would create a larger child tax credit for parents and extend some key business tax breaks in the 2017 (Trump) tax reform bill that have expired. Democrats are said to favor the former and Republicans the latter.

Opinions on the accord are all over the map, with pros and cons – both on the right and the left. I give it two cheers. If it were funded by reducing means-tested welfare spending, I would give it a third cheer.

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

A typical doctor’s office is quite spartan. The seating is usually austere. The flooring is low-budget (if there is carpeting, it is probably worn). And there are no free drinks or free food. If there is a restroom, it is probably located somewhere else in the building. More.

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Our Tattered Health Care Safety Net

We are probably as close to universal health insurance as we are ever likely to be. Yet we are doing a poor job of delivering care to families at the bottom of the income ladder. These families find that as their income goes up and down and as their job opportunities ebb and flow, they bounce back and forth among eligibility for Medicaid, eligibility for subsidized insurance in the Obamacare exchanges, eligibility for employer-provided coverage and sometimes eligible for none of the above. More.

ObamaCare Turns Out to Be Affordable Only for the Healthy

It was supposed to help those with pre-existing conditions, but they pay dearly for bad options.

How to Reform Social Security

The key to reform is to make today’s retirees positive beneficiaries of reform.

A golden opportunity to do so exists for two reasons: (1) the current system is abusing senior retirees in myriad ways, and (2) many of these abuses can be eliminated without any cost to the Treasury. In other words, some aspects of responsible reform are a free lunch.

California Dreaming

California legislators want the state to provide free health care to every resident, including undocumented immigrants. Under the act, it would be illegal for any resident to pay a doctor privately for any medical treatment covered by CalCare. John Goodman and Linda Gorman predict higher taxes, less choice, an exodus of doctors and nurses out of the state, rationing by waiting, and something actually worse than Medicaid for all. See our editorial in the Orange County Register.

Social Security Reform, Part II

To get seniors to support Social Security reform, there are additional abuses that need correcting. These include: stopping the double taxation of senior income through the Social Security benefits tax, no longer forcing seniors to dissave, abolishing the Social Security earnings penalty, and ending taxation by inflation. More

House Republicans – Raise the Debt Limit, But Stick to Your Fiscal Guns. Our Country Is Dead Broke!

Our country’s fiscal gap is 7.7 percent of GDP. This means we need to collect 7.7 percent more in taxes, every year starting now, to cover all the future spending the CBO projects. Alternatively, we need to immediately and permanently lower the path of federal spending by 7.7 percent of each future year’s GDP. Or we can do neither of these things and dig an even deeper hole for our kids. More

Social Security’s Massive Malfeasance

The Social Security administration has committed and continues to commit huge fraud against 13,000 plus widow(er)s who collectively have been swindled out of $130 million. These figures are those of Social Security’s own Inspector General. More

Should You Now Wait Till 75 To Take Your IRA?

The Secure 2.0 Act, which Wall Street loves, gives retirees the ability to defer taxable withdrawals from their IRA accounts from the current age 72 to 73 in 2023, if you reach 72 in that year or later, and to 75 starting in 2033. That may not be a good financial decision, however. More

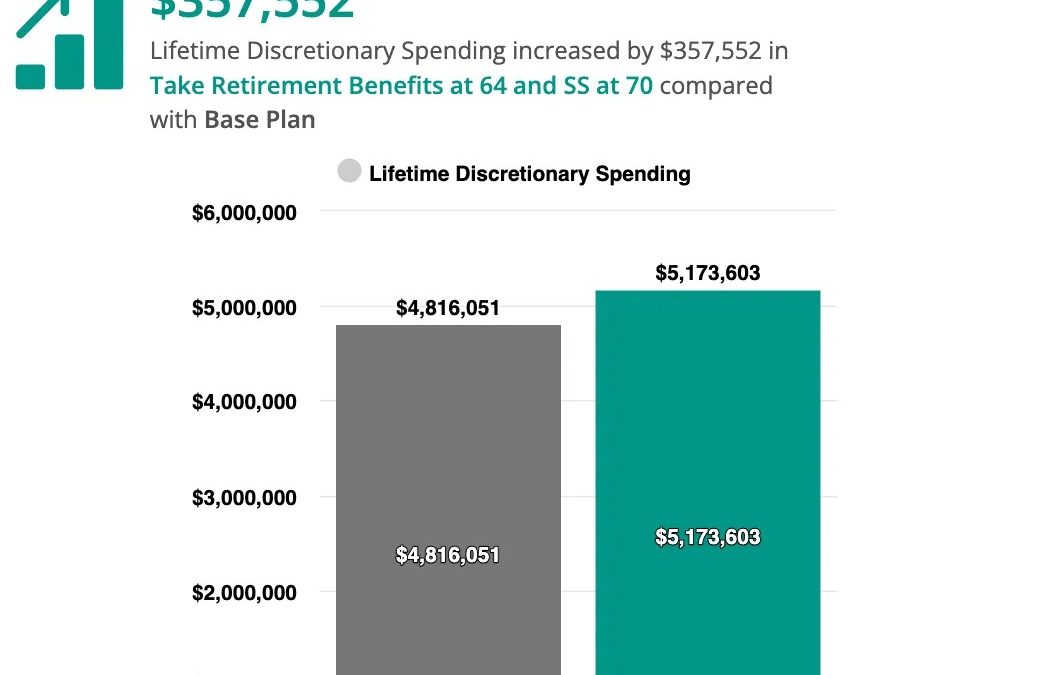

Are US retirees foregoing large sums of Social Security benefits?

90% of Americans are likely to benefit if they wait until age 70 to claim their Social Security benefits. Yet only 6% do so. If you add up the loss of benefits from these decisions over the remainder of a retiree’s lifetime, the typical retiree is leaving $182,370 (in present-value terms) on the table by claiming benefits too soon. More

Social Security COLA Still Fails To Keep Up With Inflation

The COLA is supposed to keep our (I’m also a recipient) benefits even with inflation. Unfortunately, it doesn’t. The COLA is calculated based on the rise in the Consumer Price Index between September 30th and October 1st of the previous year. Hence, we’re getting compensated for past annual inflation, with a three-month lag to boot! This leaves us perpetually behind the eight ball. More

The US is a Waning Economic Superpower

The U.S. is a waning economic hegemon. But far too few Americans, including politicians, realize this. The eventual new and very big kid on the block is, under all but extreme scenarios, China; and, after China, India. By 2100, the U.S. will be in third place, when ranked by GDP — producing only 12 percent of global output compared with China’s 27 percent and India’s 16 percent. More

The Republicans Need Their Own Student Loan Reform. Here It Is.

President Biden just canceled a mother-load of student debt. The income limit for the President's largess is $125,000 for individual borrowers and $250,000 for married and heads of households. Those below these limits received up to $10,000 in debt forgiveness. And...

Finally, A Safe Way To Play The Market — Upside Investing

Upside Investing represents a revolution in investment/spending strategy. It lets you set a living standard floor that only rises as a result of investing in stocks and other risky assets. The higher your floor, the lower your upside and vice versa.

Our Fiscal System Needs Reform

Over half of working-age Americans face lifetime marginal tax rates (including direct taxes and loss of entitlement benefits) above 43 percent. One in ten in the bottom fifth face tax rates above 70 percent, effectively locking them into poverty. For some would-be-workers, the tax rates exceed 100 percent.

Extremely high LMTRs reflect the complete loss of family benefits, in the current and future years, from programs such as Medicaid – which ends benefits abruptly if one’s income or assets exceed specific thresholds by even one dollar. More.

Social Security’s Massive Malfeasance

Social Security has committed and continues to commit huge fraud against 13,000 plus widow(er)s who collectively have been swindled out of $130 million. Those are the figures of Social Security’s own Inspector General. More

What the Debt Deal Ignored

A month ago, Social Security’s Trustees published their annual report. Table VIF1, buried deep in the Appendix, where no one looks, is the statement that Social Security’s unfunded liability is $66 trillion. This measure of Social Security’s red ink is not just gargantuan on its own. It’s $13 trillion larger than it was just three years ago. More

Should We Even Try to Recycle Plastics?

Pressuring plastic producers to recycle their products has gone on for decades. But two writers at the Atlantic have now concluded, “Plastic recycling does not work and will never work.” In the U.S. in 2021 only 5 percent of all post-consumer plastic was recycled. Furthermore, they say that the plastic producers deny this and those denials are “reminiscent of” the tobacco companies in making false claims. (For years, many tobacco firms rejected the idea that cigarettes caused cancer.)

What’s Wrong with Planting More Trees?

Planting trees to sequester carbon and prevent carbon dioxide emissions has become very popular (whether it is accomplishing much or not). Now the New York Times reports that the effort to save the world is causing local ecological harm by bringing in non-native species.

Don’t Worry about Greenland’s Melting Ice

Greenland ‘s ice mass is melting—but more slowly than it did a decade ago, and its level right now is about the same as in the 1930s. But little of this information reaches the media or even the reports of the Intergovernmental Panel on Climate Change (IPCC)…

Laws, Sausages, and Land-Grants

The agricultural and technical university, which often has “state” in its name, is typically a land-grant university formed under the auspices of the Morrill Act of 1862. It was meant to be a practical, down-to-earth “people’s university,” and even today it is less prestigious than the state’s traditional university, usually founded much earlier. But the emphasis on technology has made some of the land-grant universities research powerhouses and often bigger than their in-state rivals.

The Case for Retirement Communities

A retirement home has some resemblance to a college dorm. But that’s a good thing. Unlike a typical apartment complex, where one rarely knows one’s neighbors, a retirement home allows meeting many people—at meals, exercise classes, lectures and clubs.

Student Loans: A ‘National Catastrophe’

Review of The Debt Trap: How Student Loans Became a National Catastrophe, by Josh Mitchell (New York: Simon & Schuster, 2021) 261 pp.

Going Against the Grain

In 1973, John Baden and Richard Stroup proposed selling off the U. S. Forest Service to private owners, some nonprofit and some for-profit. In an article in the Journal of Law and Economics, they argued that commercial timber would be better managed by private companies, and non-profit organizations like the Sierra Club could protect the important environmental areas.

Conservation Leases?

This guest post by Shawn Regan is a substantive analysis of the recent proposal by the Interior Department's Bureau of Land Management to allow leasing of public land for conservation purposes. Regan is vice president of research at the Property and Environment...

Can There Be Too Many Trees?

Drought-resistant trees are replacing grasslands around the world, and, specifically in the western United States. This is a problem? More.

The “Madness of Crowds”?

Can history help us understand today’s panic over global warming? While the Earth is warming and human activity is probably contributing to it, the overheated efforts to make people fear the long-term future suggest that this is more of a crusade than a rationally considered enterprise. Extreme fear of global warming is negatively affecting politics, the economy, the media, international relations, and education.

The Federal Reserve’s Accountability Deficit

The Federal Reserve enjoys extraordinary independence from the elected branches of government, based on the well-founded fear that politicians cannot be trusted with the power to print money and manipulate interest rates.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Goodman and Saving: Budget Deal’s Trillion Dollar Surprise

The most significant federal entitlement reform in our lifetime was a little noticed provision that Democrats included in the Affordable Care Act. The provision was a cap on Medicare spending, similar to the cap Republicans proposed for Medicaid last summer.

Saving on CNBC: FED is holding 20% of federal debt

The Federal Reserve System is holding 20% of the federal government’s publicly held debt. It also is holding a lot of bank reserves. For every dollar of required reserves, banks have deposited $12 at the FED.

Tom Saving has a new book

Tom Saving has a new book called A Century of Federal Reserve Monetary Policy: Issues and Implications for the Future.

Herrick: Future Pandemics Require Better Access to Primary Care

When Americans become ill or have a health complaint, they often schedule an appointment with a primary care provider (PCP). PCPs are often the first line of defense in the battle against the onset of seasonal outbreaks of colds, flu or more serious problems like COVID-19.

Herrick: Could Free-Market Medicine Respond Better to Pandemics?

Many people have come to believe that the only way to protect Americans against future pandemics is to turn over control of our health care system to the government. The folly of this view was apparent when the U.S. Centers for Disease Control & Prevention (CDC) utterly failed as the monopoly supplier of COVID-19 diagnostic testing kits. When the first cases appeared, about half of the test kits failed and replacements were slow in coming.

How Obamacare Made Things Worse for Patients With Preexisting Conditions

One of the strange features of the national health care conversation is how it has evolved. What is often referred to as Obamacare began as an attempt to insure the uninsured. In fact, the initial Congressional Budget Office estimates predicted the Affordable Care Act would be largely successful in doing just that. Yet it was the Senate’s Democratic leader, Chuck Schumer of New York, who identified the political problem with that goal early on. About 95% of those who vote already have insurance, Schumer noted. So Obamacare was promising to spend a great deal of money on people who don’t vote.

Response to Coronavirus Reflects Trump’s Plan to Radically Reform Health Care

Critics of President Trump’s response to the coronavirus crisis characterize it as knee-jerk, spur-of-the-moment, and grasping at any straw within reach. In fact, many of the executive actions we have seen in the past few days reflect a new approach to health policy that has been underway almost since the day Donald Trump was sworn into office.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Health Reform: There Is Something for Everyone to Love… and Hate

Why is it controversial to expand the physician supply, creating more competition? Doctors oppose it, just like they oppose expanding the scope of practice for nurse practitioners. Doctors don’t want me to be able to see a nurse practitioner or physician assistant for a wart on my toe unless that NP/PA works for them.

How did doctors get so powerful? In the first half of the 20th Century, the American Medical Association (AMA) waged a largely successful battle to close medical schools that trained competing physicians. …. More than half of American and Canadian medical schools were closed…. Thus, the job of a physician was yanked out of reach of all but the smartest, most disciplined, wealthy elites.

The 60 Percent Solution to Reforming Healthcare

Can we transform the entire health care system by empowering the roughly 60 percent of patients who are in private health plans? That’s the premise of a new book I just read by Todd Furniss (@TFurniss on Twitter). The author ofThe 60% Solution: Rethinking Healthcare, believes there are five major reforms necessary to empower patients and help them get better care at better prices. These include: (1) change governance, (2) modify health savings accounts (HSAs), (3) clear prices, (4) standardize accounting and information technology in the medical industry and (5) emphasize primary care.

What’s Behind the Vaccine Slowdown?

What’s behind the slowdown in vaccinations? The consensus among experts is those not yet vaccinated either 1) don’t want the vaccine 2) harbor some doubts about vaccine safety or efficacy, or 3) simply lack the motivation to find vaccine providers and make an appointment. Vaccine hesitancy accounts for about one-third of adults. For example, the Kaiser Family Foundation ran a survey in April that found 15 percent of respondents who had not received the vaccine plan to “wait and see.” Another 6 percent will get vaccinated “only if required,” and 13 percent refuse to get the vaccine.

Linda Gorman Study: Obamacare Dollars Wasted

The percent of the population with private health insurance actually declined during the eight years of the Obama presidency, according to a study by health economist Linda Gorman.

Gorman: Obamacare has been extremely wasteful

The federal government spent $341 billion from 2014 through 2016 on subsidizing individual coverage so that people would buy it (Not counting the money spent on state and federal exchanges).

Gorman in The Hill: Doctor Incentives Rx is Failing

The Medicare Payment Advisory Commission has voted to recommend scrapping the Merit-Based Incentive Payment System because it “cannot succeed.”

Gorman in Forbes: Will Tax Reform Kill People?

You know you are in the silly season when the charges against sensible tax reform become more and more outrageous. The silliest and most outrageous is based on this causal reasoning: The Republican tax measure repeals the Obamacare mandate, requiring people to purchase health insurance; without the mandate, fewer people will insure; and without insurance, more people will die.

Gorman in The Hill: States are bilking Uncle Sam with Medicaid scams

Congress has decided to stop forcing federal taxpayers to subsidize people who live under state governments intent on levying excessive income taxes. Now, how about ending federal subsidies rewarding states that tax the heck out of health care?

Congress Could Improve Health Care by Reforming the False Claims Act

In a new Independence Institute working paper on the use and misuse of the False Claims Act (FCA), attorneys Mark W. Pearlstein and Laura McLane explain how an 1863 statute written to expose and punish Civil War contractors who billed for gunpowder and supplied kegs full of sawdust raises costs and threatens access to medical care.

Foreign Health Care is No Model for the United States

Repealing ObamaCare would produce better outcomes for patients, those who care for them, and those who pay their bills.

ObamaCare is a success — at sucking vast sums of money from the private sector

In Washington, the healthcare debate isn’t about rescuing the people in the individual insurance market from ObamaCare’s high premiums and poor coverage. Nor is it about improving patient welfare, or reducing medical costs. It’s about using the “coverage for all” mantra to suck huge sums of money out of the private sector with ObamaCare taxes, premiums, and regulations.

The $3.5T Spending Mistake

Congressional Democrats are proposing to spend an enormous amount of taxpayer dollars on what the New York Times calls a “cradle to the grave” addition to U.S. social welfare. When budgeting shenanigans are ignored, the Committee for a Responsible Federal Budget estimates that the full cost is not the $3.5 trillion that has been widely advertised, but at least $5.0 trillion and possibly as much as $5.5 trillion.

Gorman: US Hospitals are Safer

A frequent criticism of US hospitals is the charge of excessive adverse medical events, sometimes leading to avoidable deaths. How do our hospitals compare to hospitals in national health care systems? Quite well. The percent of patients who experience an adverse event is twice as high in Canada, three times as high in Britain and four times as high in New Zealand.

Against Medicaid Expansion

Expanding Medicaid to the relatively healthy might make sense if it improved general health. But there is little evidence it does. In Oregon, for example, a first-of-its-kind controlled trial tracked individuals who applied for Medicaid through a lottery. After two years, there was no discernible difference in the physical health of the winners and losers. More

Obama’s Foreign Failure

The world hasn't lived up to his Pollyannaish expectations. Commentary by Pete du Pont August 27, 2013 Source: The Wall Street Journal Barack Obama entered the White House with the promise of restoring our nation's standing in the world. Suffering from war fatigue and...

Second-Term Nightmare

ObamaCare's chickens come home to roost. Commentary by Pete du Pont July 27, 2013 Source: The Wall Street Journal Talk about being between a rock and a hard place. The Obama administration and its allies in Congress are faced with the challenge of trying to convince...

Obama’s Anti-Energy Agenda

He threatens to cut off the fuel the economy needs. Commentary by Pete du Pont July 01, 2013 Source: The Wall Street Journal Not surprisingly, President Obama and Speaker John Boehner have different views on energy policy, differences brought into stark contrast by...

Obama’s Scandalous Legacy

He has given Americans new reason to distrust the government. Commentary by Pete du Pont May 28, 2013 Source: The Wall Street Journal It's too early to tell if May will be remembered as marking the beginning of a failed second term for President Obama, but it is clear...

Make Government Less Taxing

Our returns don't have to be this unhappy. Commentary by Pete du Pont April 26, 2013 Source: The Wall Street Journal Americans don't like things that are inefficient, costly or unfair. Our federal tax code seems designed to be all three, a failing exacerbated by a...

Peace Through Strength: Still a Good Idea

Has Obama overcome his foreign policy naiveté? Commentary by Pete du Pont March 29, 2013 Source: The Wall Street Journal The domestic policies of the Obama administration evince a lack of understanding and experience in how an economy functions and grows. Things are...

The Democratic Majority Is Doomed

The entitlement mentality can't survive a weak economy. Commentary by Pete du Pont March 01, 2013 Source: Wall Street Journal Many argue the coalition that elected and re-elected Barack Obama represents a long-term shift in the electorate that will determine...

Big Bird Should Leave the Nest.

Romney was right about public broadcasting. Commentary by Pete du Pont January 31, 2013 Source: Wall Street Journal It's time to end the federal subsidy for public broadcasting. Doing so now would be good for President Obama, Congress and the American taxpayers. And,...

Our Gravest Peril

ObamaCare? Stagnant economy? Crushing debt? Foreign policy fecklessness may trump them all. Commentary by Pete du Pont January 21, 2014 Source: Wall Street Journal America's most worrisome problem may not be the failed takeover of our healthcare system. It may not be...

The Great Destroyer

ObamaCare wreaks havoc on health care, the economy, American freedom and Obama's presidency. Commentary by Pete du Pont November 25, 2013 Source:The Wall Street Journal Polls show an increasing majority of Americans dislike President Obama's healthcare law and...

The Left’s “Wars”

The Left’s “Wars” Commentary by Pete du Pont March 28, 2014 Source: The Wall Street Journal The midterm elections are just over seven months away and the left has unleashed its usual rhetoric about the Republican "war on women." It's baseless political pandering of...

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.

Biden v. Medicare Advantage

When does the failure to answer a phone call in 8 seconds cost the company receiving the call $190 million? When the caller is a spy working for the agency that runs Medicare and the receiving entity is a private insurance company. More.

Leftists in Colorado Seem Poised to Try Again for Single Payer Health Insurance

Last time around, the idea was rejected by almost 79% of the voters. And for good reasons. British Columbia’s single payer system is so mismanaged it pays for cancer patient radiation treatments in Bellingham, Washington. Its hip replacement wait can be almost a year… Because Canadian patients wait twice as long as recommended for MRI scans, those who can afford it pay cash for quick service at US imaging centers in border cities like Buffalo, NY and Bellevue, WA. More.

Two Cheers for the Bipartisan Tax Deal

A rare bipartisan agreement in Congress would create a larger child tax credit for parents and extend some key business tax breaks in the 2017 (Trump) tax reform bill that have expired. Democrats are said to favor the former and Republicans the latter.

Opinions on the accord are all over the map, with pros and cons – both on the right and the left. I give it two cheers. If it were funded by reducing means-tested welfare spending, I would give it a third cheer.

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

A typical doctor’s office is quite spartan. The seating is usually austere. The flooring is low-budget (if there is carpeting, it is probably worn). And there are no free drinks or free food. If there is a restroom, it is probably located somewhere else in the building. More.

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

How to Reform Social Security

The key to reform is to make today’s retirees positive beneficiaries of reform.

A golden opportunity to do so exists for two reasons: (1) the current system is abusing senior retirees in myriad ways, and (2) many of these abuses can be eliminated without any cost to the Treasury. In other words, some aspects of responsible reform are a free lunch.

California Dreaming

California legislators want the state to provide free health care to every resident, including undocumented immigrants. Under the act, it would be illegal for any resident to pay a doctor privately for any medical treatment covered by CalCare. John Goodman and Linda Gorman predict higher taxes, less choice, an exodus of doctors and nurses out of the state, rationing by waiting, and something actually worse than Medicaid for all. See our editorial in the Orange County Register.

Social Security Reform, Part II

To get seniors to support Social Security reform, there are additional abuses that need correcting. These include: stopping the double taxation of senior income through the Social Security benefits tax, no longer forcing seniors to dissave, abolishing the Social Security earnings penalty, and ending taxation by inflation. More