-

The American economy is already at full employment

In January 2024, the unemployment rate stood at 3.7%, a figure that economists equate with “full employment.” Why not 0%? That would mean everyone is working and no one is searching. In that case, employers with job openings would find it hard to fill those slots and employees with better earning prospects would be at work instead of interviewing for jobs. A small amount of temporary unemployment serves an economic function similar to inventory. If retail outlets didn’t have inventory, they would frequently run out of products consumers want to buy. https://corporatefinanceinstitute.com/resources/economics/natural-unemployment/

-

Private sector employment can be more productive than public sector employment

In a full employment economy, a public sector job cannot be filled unless it pulls a worker from the private sector. Other things equal, that makes the economy less efficient and less successful in meeting consumer needs. The most important question to ask of any production system is: What incentives do people have to make good decisions rather than bad ones? In a competitive economy people tend to get the full benefit of their good decisions and pay the full cost of their bad decisions. Workers who make good decisions tend to get promotions and raises. Those who make bad decisions tend to get laid off. If investors make good decisions, they profit. If they make bad decisions, they incur losses. In the public sector, things are usually quite different. For example, in most cities it is very hard to fire a bad teacher or a bad police officer. Take New York: It costs an average of $313,000 to fire a teacher in New York state. New York Department of Education spends an estimated $15-20 million a year paying tenured teachers accused of incompetence and wrongdoing to report to reassignment centers where they are paid to sit idly. In New York, it can also take up to six years to remove a tenured teacher. In the last two decades of the 20th century there was an international privatization movement. In countries everywhere, governments began to sell assets – such as state-owned enterprises

– to the private sector. The reason: the general recognition that the incentives in the private sector produce more efficient outcomes than those in the public sector. In the United States, this movement saw its greatest impact in the city privatization movement in the 1990s. Prior to that time, most cities used their own employees to pick up trash, remove snow, maintain roads, trim trees, maintain water systems, etc. This meant that the typical city manager was actually running a slew of different and largely unrelated businesses. Anyone who could do that well would be a super manager – someone likely to get snapped up by a private company and paid a much higher salary. Not surprisingly, these tasks were typically not done well. So, cities began contracting with private firms that specialized in trash collection. And private firms competed for the city contract. They then privatized other services. Contracting out to the private sector has generally meant better service at less cost for most municipalities. For it to work well city managers have to avoid the temptation of corruption and they have to be good at negotiating and managing contracts. That generally happens, but not always. The privatization movement of the late 20 th century was world wide – at the city, state and national level. Outside of Cuba, North Korea and maybe Venezuela, it’s hard to find a country that thinks public production is superior to private production.

https://fordhaminstitute.org/national/research/undue-process-why-bad-teachers-twenty-fi ve-diverse-districts-rarely-get-fired

https://nypost.com/2016/01/17/city-pays-exiled-teachers-to-snooze-as-rubber-rooms-retur n/

https://reason.com/wp-content/uploads/assets/db/12639308918768.pdf

https://reason.org/policy-brief/local-government-privatization-101/

https://hbr.org/1991/11/does-privatization-serve-the-public-interest

-

The Federal Jobs Mandate does not reduce household income inequality and might even make inequality worse.

If a public sector job were available at a certain wage level, no one would have to accept a private sector job at a lower wage. In this way, public sector jobs could set a lower limit on what the private sector is paying. Here are some problems with that idea:

-

It doesn’t matter what entry level jobs pay. According to McDonalds, 1 in 8 Americans has worked at one of its restaurants. In all probability it was their first job. You don’t see many old people working at McDonalds. If you want to do well in the labor market, you have to start somewhere. Simple skills like showing up at work on time, following orders, being respectful to employers and customers – these are not skills most people are born with. They have to be learned. If you start out as a New York City teacher, you may never learn them. The skills teenagers learn at their first job starts them out on the first rung of their work life odyssey. Basic work skills learned in an entry level job are far more important for success in life than the entry level wage.

-

A worker’s wage is a poor guide to household income. In addition to wage income, people have capital income (rent, interest, capital gains, etc.), entitlement income (tax credits), etc. More importantly, workers who earn wages live in households with other people who also have Incomes. Using public sector jobs as a tool to put a floor under the wage people are paid is very much like a minimum wage. That means that studies of the effects of minimum wage law are relevant here.

-

Many economists have pointed out that as a poverty- fighting measure the minimum wage is horribly targeted. The same principles would apply to a wage floor brought about by public sector jobs of last resort. One study found that only 11.3 percent of workers who would benefit from raising the wage come from poor households. [Joseph Sabia and Richard Burkhauser, “Minimum Wages and Poverty: Will a $9.50 Federal Minimum Wage Really Help the Working Poor?] A study by Thomas MaCurdy of Stanford found that there are as many individuals in high-income families making the minimum wage (teenagers) as in low- income families. [Thomas MaCurdy, “How Effective is the Minimum Wage in Supporting the Poor?] MaCurdy also found that the costs of raising the wage are passed on to consumers in the form of higher prices. Minimum-wage workers often work at places whose customers have low incomes. So, raising the minimum wage is like a regressive consumption tax paid for by the poor to subsidize the wages of workers who are often middle class. [How Effective is the Minimum Wage in Supporting the Poor?]

-

A floor on private sector wages could also hurt job opportunities for the very people it is supposed to help. Numerous studies find that when the minimum wage is set above the market clearing wage, fewer workers are hired by private employers and those that are hired are often forced to work fewer hours of work. [For a study and a review of the literature, see David Neumark, et. al., “More Recent Evidence on the Effects of Minimum Wages in the United States.”] Because low-wage workers get less work experience under a higher minimum-wage regime, they are less likely to transition to higher-wage jobs down the road. [Jeffrey Clemens and Michael Wither, “The Minimum Wage and The Great Recession: Evidence of the Effects on the Employment and Income Trajectories of Low- Skilled Workers.”

https://www.today.com/food/restaurants/mcdonalds-1-in-8-initiative-rcna120187 https://izajolp.springeropen.com/articles/10.1186/2193-9004-3-24#B13 https://www.nber.org/system/files/working_papers/w20724/w20724.pdf

-

Little evidence of market failure in the market for low-skilled workers

Economics teaches that government intervention can sometimes improve social welfare when there are “market failures.” For example, when there is monopsony (single buyer of labor), employment will be suboptimal and the wage rate will be too low. In this case, a floor under the wage rate would increase employment and labor earnings at the same time. Yet there is very little evidence of market failure in the market for low-skilled workers.

In 2016, Hillary Clinton made the “$15 minimum wage” a plank in her presidential campaign and there was political pressure to pass “$15 dollar” state and local minimum wage laws all over that country.

Yet by 2022, with hardly any new legislation anywhere, the average wage paid to fast food workers nationwide was $17.20. In some places, it was as high as $28.61. During the pandemic, we got a glimpse of how well the labor market actually fits the textbook economics theory of labor market supply and demand. In a post at Forbes, John Goodman wrote:

Example: [For real eye-popping numbers, nothing quite tops the market for nurses. Before the pandemic, nurses earned an average of $73,300, or $1,400 per week. In the early stages of Covid, their pay rose by 25 percent. Then, a bidding war started as hospitals tried to fill shortages by luring prospects from other cities

The number of nurses who engage in temporary travel to take advantage of lucrative pay deals in another city rose from 5,226 in January, 2019 to 36,364 in January, 2022. According to a Health Affairs study, traveling nurses [were] being paid between $5,000 and $10,000 a week!]

https://www.google.com/url?q=https://www.forbes.com/sites/johngoodman/2022/05/07/whatever-happened-to-the-15-minimum-wage/?sh%3D42bfd3614dfd&sa=D&source=docs &ust=1707179269122194&usg=AOvVaw1B7xpIzc4clcd8e3fuZBmc

https://www.nytimes.com/issue/magazine/2022/02/18/the-22022-issue

https://www.healthaffairs.org/content/forefront/covid-19-s-impact-nursing-shortages-rise-travel-nurses-and-price-gouging#:~:text=In%20April%202020%2C%20during%20the,% 245%2C000%20and%20%2

-

A public sector jobs program would likely have no effect on wage differentials between genders and race

The fact that the average wage income of women in our economy is lower than the average wage income of men is sometimes said to reflect a social problem, or perhaps even a labor market failure. But this is like comparing apples and oranges. On average, men and women don’t make the same career choices, don’t work the same number of hours, and tend to have different roles in household life. So why would anyone expect their labor market earnings to be the same? Former Congressional Budget Office director June O’Neill compared the earnings of middle aged women and men who were childless and found that the women earn more than the men.Overall, she found that career choices, lifestyle choices and work experience explain almost all the gender gap in labor market earnings. As for racial discrimination, O’Neill and her husband Dave find that after adjusting for years of education and test scores, there is virtually no difference between the pay of white and black men. After a similar adjustment, black women actually earn more than white women.

An important distinction is between individual acts of discrimination and market wide discrimination. We know there are individual acts of discrimination, because there have been many civil rights lawsuits where compelling evidence has been produced. However, for the market as a whole to discriminate we would need to find cases where Black and white workers are paid different wage rates for identical work. We don’t know of any such cases today.

In a capitalist economy it would be hard for market wide discrimination to survive. Suppose Black workers were paid less than white workers for the same work. Then an entrepreneur could hire only Black workers, have a cost advantage over his rivals, charge lower prices and capture the market for his rivals.

In South Africa’s Apartheid system and in the US pre-civil-rights South, market-wide discrimination was possible because it had the backing of the government.

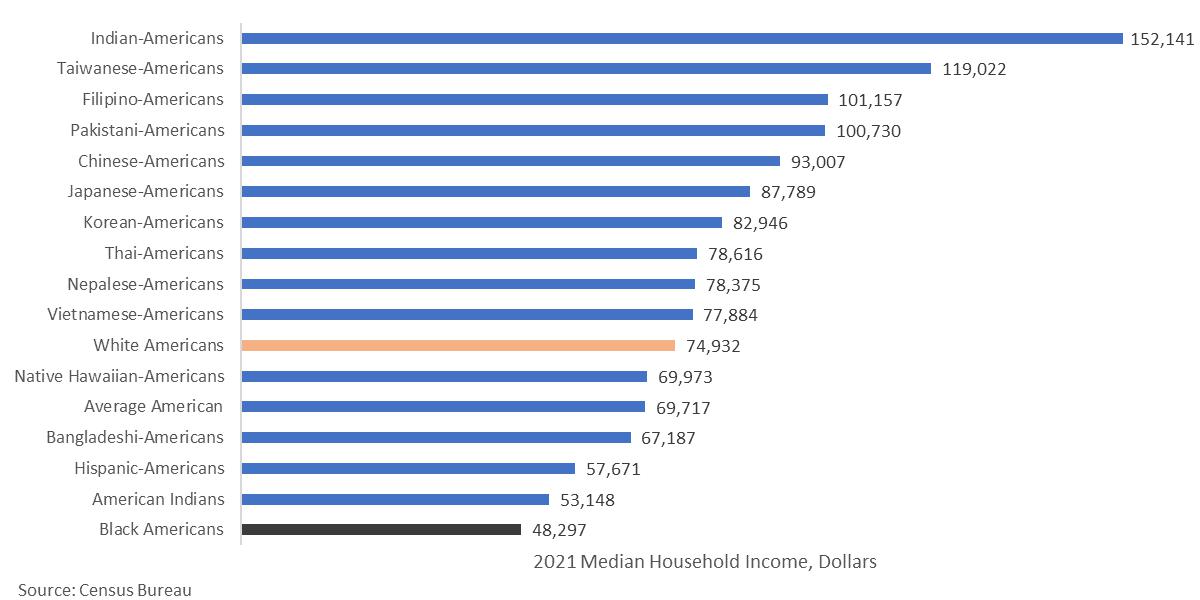

It is sometimes said that white workers are “privileged” or have an advantage in the labor market versus various racial and ethnic groups. But as the chart below shows, white households are very much in the middle of the pack.

-

Contracting with the private sector is better than government-created jobs.

There are a number of socially desirable goods and services that the private sector doesn’t naturally produce on its own. But as noted, governments around the world are more commonly relying on contracts with private producers rather than government production. The most obvious example in the US at the federal level is health care. Instead of a government-run system (of the type Sen. Bernie Sanders would prefer), 72 percent of enrollees in Medicaid (for the poor) are in private health care plans. More than half of enrollees in Medicare (for the elderly and the disabled) are in private plans. Virtually everyone who gets insurance in the Obamacare exchanges (for people who buy their own health insurance) is in a private plan. We do have some government-run health systems that are holdovers from an earlier era. The Indian Health Service is one. The Veteran’s Administration is another. Both systems are replete with problems that have persisted for decades. Perhaps for that reason, no one is arguing for an expansion of these

programs, making them available to more people. [To pick one example of the difference between contracting with private suppliers and public production, private Medicare Advantage plans are required to answer a certain type of phone call from enrollees within 8 seconds, and the government uses “secret shoppers” to test the plans’ compliance. In one case, the insurer Elevance (formerly Anthem) answered 23 straight phone calls within 8 seconds, but failed to pick up on the 24th (the company alleges this last call never occurred). Because of that one missed call, the company got a lower quality rating and payments from the government were reduced by $190 million. By contrast, Social Security takes 35 minutes on average before it picks up the phone, and endures no penalty at all. The IRS doesn’t even answer most of its phone calls, picking up the phone only 29 percent of the time.]

https://www.macpac.gov/publication/percentage-of-medicaid-enrollees-in-managed-care-by-state-and-eligibility-group/

https://www.kff.org/medicare/issue-brief/a-snapshot-of-sources-of-coverage-among-medicare-beneficiaries/#:~:text=In%202021%2C%20Medicare%20Advantage%20covered,% 25%20of%20all%20eligible%20beneficiaries.)

https://www.cms.gov/marketplace/about/overview-exchanges

https://www.nytimes.com/2019/10/15/us/politics/native-americans-health-care.html#:~:te xt=The%20problems%20at%20Sioux%20San,and%20are%20treated%20by%20staff

https://www.latimes.com/opinion/story/2021-05-31/veterans-healthcare-denied-access

https://www.bloomberg.com/news/articles/2024-01-23/medicare-advantage-elevance-say s-one-phone-call-cost-it-190-million

https://www.washingtonpost.com/politics/2023/02/18/social-security-services-degrade-co ngress/

https://www.nytimes.com/2024/01/10/us/politics/irs-tax-report-congress.html

-

Creating make work jobs do not make everyone better off

The Luddites were 19th-century English textile workers who opposed the use of certain types of cost-saving machinery, often destroying the machines in clandestine raids. Ever since, the term “Luddite” has been associated with the idea that new inventions and new machinery can substitute for labor and make workers worse off. Modern economics has a well-established tradition of rejecting the Luddite view, based on a long record in industrial countries of real wage growth even among the least skilled. However, with advances in artificial intelligence, some of our best economists are taking the Luddite view seriously with respect to AI.

As noted, if AI can produce, say, 30 percent of our GDP, that is potentially a good thing. Remember, the robots are not going to eat the food, live in the houses, or drive the cars.

Only humans can consume. Also, even if people lose their current jobs, they will almost certainly have opportunities to do other jobs. There will probably never be a time when there is no demand at all for the labor of 30% of our population. But suppose it did happen. Is the answer to create “make-work” – say, paying people to dig holes and then cover them up? What would that accomplish? As noted above, the problem AI creates is not a job problem. It is a consumption problem. If AI is doing all the work, we need to make sure everybody shares in the consumption of the goods and services AI produces. Boston University economist Laurence Kotlikoff and Columbia University economist Jeffrey Sachs have done some very sophisticated AI modeling and concluded that on some assumptions AI development has the potential to make younger generations worse off. Yet the answer to that development is not to create a lot of make-work jobs. The answer is to redistribute income from those who gain from the transition to those who do not. The authors write: The Luddites may, therefore, have had a point after all. Advances in machine productivity can indeed commiserate today’s young and future generations. But does this mean that we should smash the machines? Here we can benefit from a bit more insight. Instead of smashing the machines (or more prosaically, preventing their deployment), we can instead use inter-generational tax-and-transfer policy. When the older generation enjoys a windfall from the advance of technology, the government can tax some of that windfall, and then use the proceeds to improve the wellbeing of today’s youth and of future generations. With the right choice of tax-and-transfer policies, all generations can benefit from the advance in technology, while under laissez faire, only today’s older generation benefits, and at the expense of all other generations.

https://www.nber.org/system/files/working_papers/w18629/w18629.pdf

0 Comments