1. UBI Fails to Substantially Reduce Inequality

Over the last 60 years, the rich have not gotten richer and the poor have not gotten poorer. But there has been a substantial increase in inequality among the broad middle class. The reasons for this inequality appear to be lifestyle choices that are causing individuals and families to follow very different paths, with stark economic consequences. Giving checks of equal amounts to everyone in the middle of the income ladder will not by itself reduce inequality among this group. If you include non-cash benefits, giving the same annual lump sum to everyone who is not rich, funded by a tax on the rich, would make the rich less rich relative to everyone else. But it would not change the broad increase in inequality among the middle class that has been documented.

https://www.journals.uchicago.edu/doi/10.1086/728741 https://www.vox.com/future-perfect/2024/1/11/23984135/inequality-auten-splinter-piket y-saez-zucman-tax-data

2. UBI doesn’t improve the economic wellbeing of the poorest individuals

Analysis: Many of these folks don’t have a mailbox. Or a bank account. Or even an actual residence. Most plans to implement UBI envision that the money will be dispersed the way Covid checks were dispersed (money went right into the recipient’s bank account.) That doesn’t help the homeless.

According to the report, 81% of adult Americans are fully banked, 13% are underbanked, and 6% are unbanked. The share of Americans with each banking status in 2021 remained almost constant from 2020.

https://usafacts.org/articles/who-is-the-least-likely-to-have-a-bank-account-in-the-us/

3. UBI is extraordinarily wasterful

UBI is wasteful because there is an enormous amount of spending that does not reduce inequality in any substantial way and an enormous amount is given to people who don’t need it. Example: In 2020, Sen. Kamala Harris proposed $2,000 payments each month “to every individual, including children and other dependents” during the duration of the Covid crisis. Only the very rich would be excluded. The cost to the federal government would be $6 trillion a year. Ignoring interest payments, this would double the size of federal spending, and therefore double the size of the nation’s tax burden. But since everyone who wasn’t very rich would be getting the same amount of money, this would do nothing to reduce inequality among 90% + of the population.

https://www.aei.org/research-products/report/small-dollar-demonstration-projects-cant-h de-that-a-national-guaranteed-income-program-would-cost-trillions/

4. There is no practical way to implement UBI

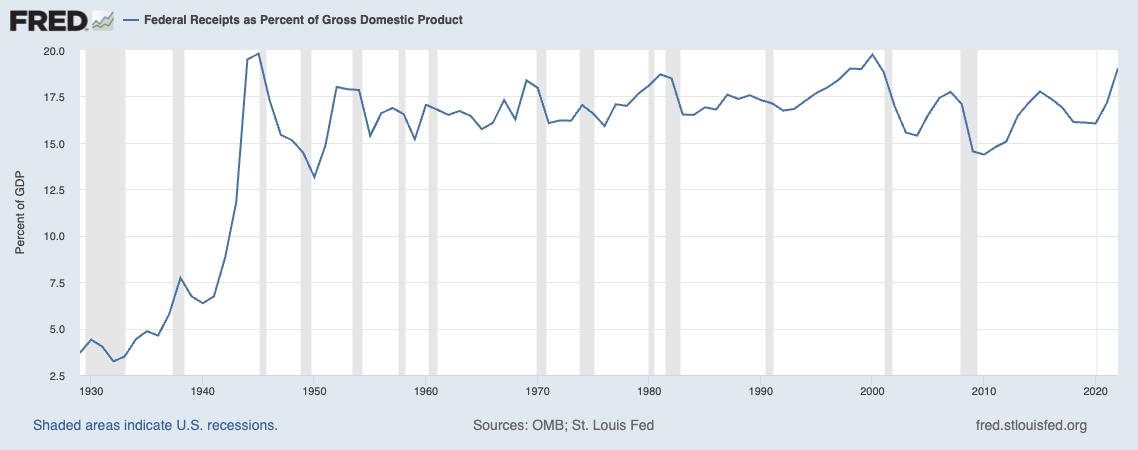

Over the last 70 years federal tax revenues have averaged about 18% of GDP. They have never reached 20% — even in WWII when Americans were making all kinds of sacrifices, and even when the top tax bracket was 91% in the 1950s. Since the upper limit of federal revenue has not been exceeded despite 70 years of changes in the tax code, why would anyone think that collecting as much as twice the historical intake is possible?

Questions for AFF: we have never doubled taxes, what new tool are you going to use to make this happen?

https://fred.stlouisfed.org/series/FYFRGDA188S#

5. Making the UBI non-universal has socially undesirable consequences.

Analysis: According to the dictionary “universal” means everyone. That is what the debate topic seems to require. Nevertheless, in order to reduce the cost and avoid the waste of a truly universal approach, some UBI proposals would phase out the benefit at some level of income. This is called “means testing.” A New School proposal, for example, would give adults $12,500 every year, but the amount phases out (reduces to zero) as the recipient’s other income rises from $10,000 to $50,000. Here are the problems with:

Penalties for working: When an individual earns a dollar, he loses 30 cents of UBI money. People at the bottom of the income ladder already face very high implicit marginal tax rates because of the phase out of other in-kind benefits (health care, food stamps, etc.) Add another 30 percentage points and the reward for working could drop to zero!

Penalties for marriage: For a married couple, the UBI completely phases out at $70,000 and the penalty for working is 45 cents for every additional dollar. The couple would be better off not getting married.

Increasing inequality: When non-cash entitlement benefits are counted as income, the bottom three quintiles of the income distribution (bottom 60 percent) have roughly the same average income. If you give the bottom quintile substantially more income than the quintile above it, you have created inequality.

Dr. Goodman from The Goodman Institute

https://www.goodmaninstitute.org/2022/10/24/what-i-bet-you-dont-know-about-poverty-nequality-and-the-role-of-government/

https://kotlikoff.net/wp-content/uploads/2023/06/The-Marginal-Net-Taxation-of-Americ ns-Labor-Supply-7-27-23.pdf

6. UBI could make anti-social behavior and even inequality worse.

The distinguishing characteristic of UBI is that it is unconditional. No one has to change his behavior. What is the cause of low incomes? Is it circumstances over which people have no control? Or is it because of personal choices? A career lasting 6 years will provide an NFL football player with more earnings than an average college graduate will get in an entire lifetime. Yet according to a Sports Illustrated article, 78 percent of former NFL players are bankrupt or under financial stress within two years of retirement. A UBI for this group would take away the financial penalty for making bad decisions and encourage future players to make more of them.

https://vault.si.com/vault/2009/03/23/how-and-why-athletes-go-broke

7. UBI encourages the homelessness to remain homeless

A lot of homelessness is homelessness by choice. The fact that California is fairly generous to the homeless, may explain why half the homeless in the country are in California – a comparatively wealthy state. A UBI would encourage more homelessness everywhere. If it is true that our most serious inequality problem is among the broad middle class and that the problem arises because of behavioral choices, then the very act of handing everyone a check regardless of behavior ends up subsidizing the very lifestyle choices that gave rise to the problem.

https://homelessness.ucsf.edu/our-impact/our-studies/california-statewide-study-people-e xperiencing-homelessness

8. UBI encourages behavior that keeps people from advancing from poverty to the middle class

Analysis: Scholarly studies show that young people can virtually assure that they and their families will avoid poverty if they follow three elementary rules for success – (1) complete at least a high school education, (2) work full time and (3) wait until age 21 and get married before having a baby. Our fiscal system doesn’t do much to keep kids in school. But it strongly discourages work and marriage for those at the bottom on the income ladder. Since the War on Poverty started in 1965, the labor force participation of the bottom one-fifth of households – who now receive more than 90 percent of their income from the government – has dropped from 70 percent to 36 percent. It’s not hard to understand why.

“Young people can virtually assure that they and their families will avoid poverty if they follow three elementary rules for success – complete at least a high school education, work full time, and wait until age 21 and get married before having a baby.” It is not often that such a definitive statement is made about how to avoid poverty. The statement is powerful because it is based on Census Bureau data. Mr. Haskins and Ms. Sawhill crunched the data and learned that “people who followed all three of these rules had only a 2 percent chance of being in poverty and a 72 percent chance of joining the middle class (defined as above $55,000 in 2010).”

https://federalsafetynet.com/a-98-proof-plan-to-avoid-poverty/

9. UBI encourages the unmarried to remain unmarried

Analysis: The system also discourages marriage through lower welfare/entitlement benefits for married couples.

One finding: young adults with low- or middle-income jobs pay a heavy price if they marry. When higher tax rates are combined with a reduction in welfare/entitlement benefits, the economic loss from marriage is equal to between one-and-a-half and two years of income, on average.

Example: Take two people between the ages of 26 and 40:

-

If both individuals earn $10 an hour, getting married will lower their lifetime income by more than $70,000, on average.

-

If they earn $15 an hour, the lifetime losses will climb to more than $107,000.

-

At $20 an hour, their loss will be more than $142,00.

https://www.goodmaninstitute.org/2022/07/17/the-marriage-tax/

10. UBI would likely cause people to drop out of the labor force

There have been two federal experiments that were long term in duration. In the 1970s, there were UBI experiments that lasted for many years. American Enterprise Institute economist Leslie Ford reports that: Overall, $1,000 in added benefits was offset by a $660 earnings reduction. The reduced earnings persisted long after the programs ended: Each $1 increase in benefits led to a roughly $5 drop in recipients’ lifetime earnings. The other ongoing experiment was the Aid to Families with Dependent Children (AFDC) program, established by the Social Security Act of 1935. The program sent money to low-income single mothers without requiring them to work. By 1996, when welfare reform brought the program to an end, barely 1 in 10 recipient families included a worker. Most were stuck in long-term poverty.

https://www.wsj.com/articles/cities-use-covid-funds-to-run-guaranteed-income-experime nts-policy-aid-covid-money-0d2fe659?st=1c2dsvckns7kktv&reflink=desktopwebshare_p ermalink

11. Benefits of inequality

Nobel Laureate William Nordhaus estimates that innovators are able to capture about 2.2 percent of the total surplus from innovation. That means that 98% of the value of what they produce flows to the rest of society. A successful economic system is likely to be one that confers large rewards on people who make very valuable contributions to it.

Example: Take IQ. The average is 100. But what if everyone had an average IQ of 100? We never would have discovered Newton’s laws of physics, Einstein’s theory of relativity, quantum mechanics, and many other inventions and innovations. The fact that some people are born with an IQ that is 4 or 5 standard deviations above the mean, is enormously beneficial to those of us who are not in the top 1% on the IQ scale.

https://www.nber.org/digest/oct04/who-gains-innovation

12. Redistributing money inevitably results in loss

If we accept the idea that eliminating inequality is a good thing to do, we must also accept the fact that there is a cost to eliminating it. The economist Arthur Okun described this as the leaky bucket problem. Imagine trying to shift water from one pool to the next. If the bucket has leaks, some water will be lost in the process. In a similar way redistributing money from one group to another will inevitably result in an efficiency loss — a loss of output for society as a whole. One way to see that is to recognize that tax on above average income earners is a tax on success. A subsidy for low-income earners is a subsidy for a failure to be successful. The more we tax success and reward failure, the less we will have of the former and the more we will have of the latter. Redistribution makes society as a whole less prosperous than it would otherwise be.

https://www.econlib.org/library/Enc/bios/Okun.html

13. The problem with Jamestown

The range of options stretches from doing nothing about inequality to attempting to eliminate it altogether. Total elimination would mean using UBI to create equal income for everyone, regardless of what they do. If anyone earns more than the universal average, that income would be taxed away. If anyone earned less, their income would be subsidized up to the universal average. Our very first Jamestown Colony was actually organized in this way. (We started out as a socialist country!) but because there was no reward for work, people had perverse incentives to shirk and let others produce. The result: the colony was on the verge of starvation. The problem was solved by creating property rights and allowing people to retain the product of their own labor.

0 Comments