Both the Senate and House Republicans have now spoken about their preferred tax reforms. The differences between them are relatively minor.

Both the Senate and House Republicans have now spoken about their preferred tax reforms. The differences between them are relatively minor.

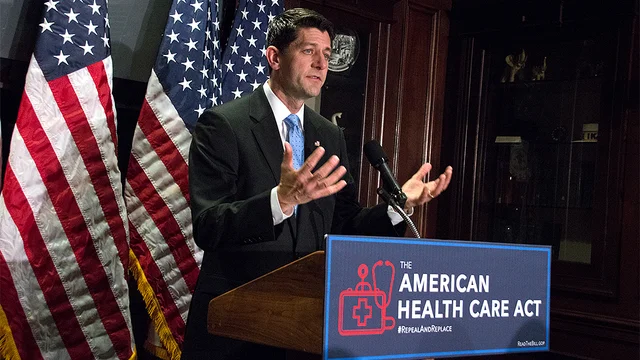

The GOP tax plan should do three things. It should expand the economy while raising wages. It should pay for itself. And it should be fair.

Former Treasury Secretary Lawrence Summers wrote an op ed for the Washington Post on October 8 calling the Trump Administration’s tax plan “an atrocity.”

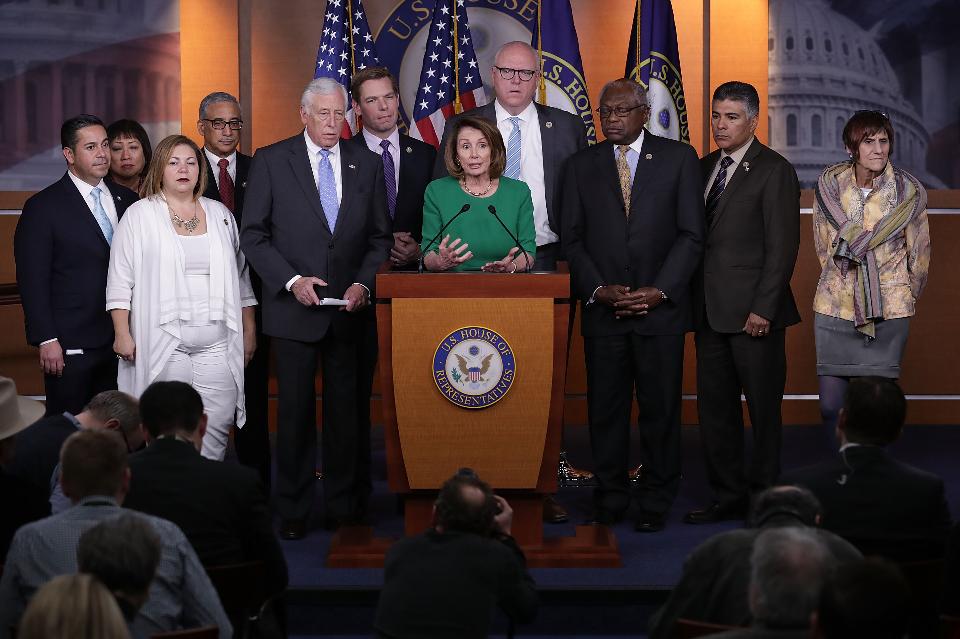

On the surface, it would seem that Republicans and Democrats are so far apart that agreement on health policy is virtually impossible. Scratch the surface and you will find another reality.

Goodman Institute is hosting a Capitol Hill briefing on the House Republican tax plan with Chairman Kevin Brady, and Boston University economist Laurence Kotlikoff.

Why can’t Republicans be more like Democrats?

As I’ve written, the House Republican tax bill has a lot to recommend it, including to Democrats. It needs some tweaks and proper transition rules to ensure it’s at least revenue neutral and as progressive as the current system (which, as you can read here, is far more progressive than commonly believed).