Taxes

House GOP tax plan really is a ‘Better Way’

Last June, Republicans in the House Ways and Means Committee rolled out their “Better Way” tax reform plan. It proposes big changes to business and personal taxation. Critics say it’s regressive and will likely decrease revenues because of the cut in personal rates.

How The Fed Can Save The House Tax Bill

As I’ve written, the House Republican tax bill has a lot to recommend it, including to Democrats. It needs some tweaks and proper transition rules to ensure it’s at least revenue neutral and as progressive as the current system (which, as you can read here, is far more progressive than commonly believed).

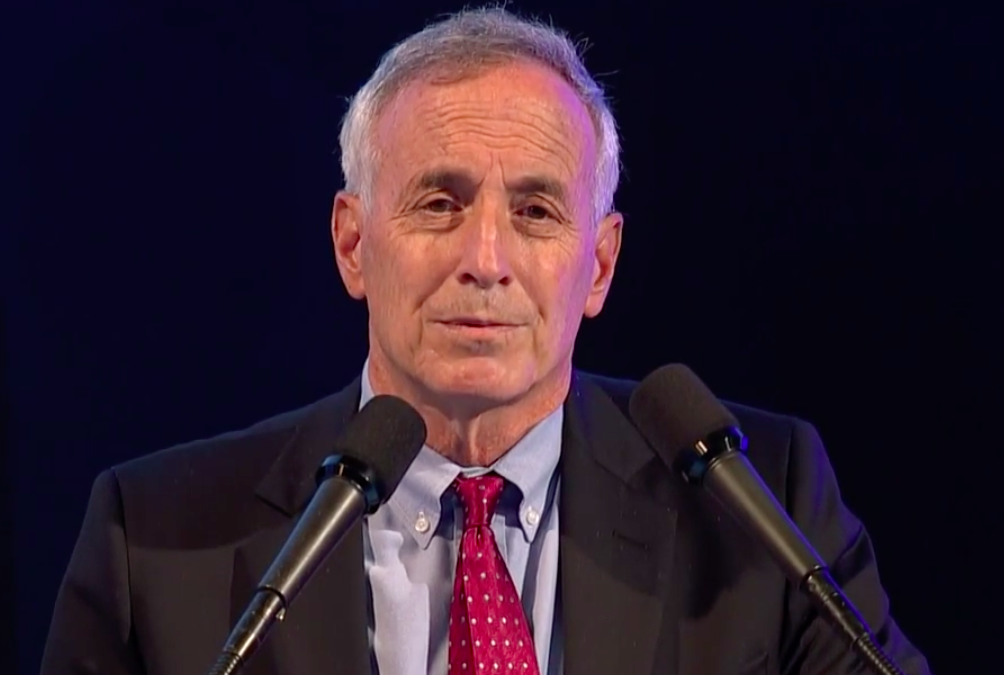

Kotlikoff Replaces Scott Burns as Author of Syndicated Column

After 40 years of writing financial opinion pieces for the Dallas Morning News, Scott Burns has retired. Larry Kotlikoff will replace Burns in the weekly column, providing his insight into taxes, Social Security and Medicare.

Kotlikoff: Does the new Social Security law stop you from reclaiming your suspended benefits? Maybe not

Alan Skupp is an attorney who lives in Livingston, New Jersey. He and his wife run a market intelligence company.

Kotlikoff Debates Piketty: Do We Need A Wealth Tax?

Thomas Piketty’s best-selling book Capital in the 21st Century took the spotlight in the field of economics of 2014. A number of scholars even claim that the 21st century economics is divided into two eras: pre-Piketty and post- Piketty economics. Thomas Piketty is visiting Seoul for the first time this year in order to speak about his book Capital in the 21st Century and he will also hold a group discussion with other global scholars from around the world on his book.

Why Do We Have A Death Tax?

Not all taxation is theft. But one tax that comes about as close as possible to being theft is the estate tax. After all, dead people aren’t getting any more services from government.

The Promise Of America: Opportunity, Not Equality

The topic de jure for the chattering class these days is inequality. In fact, it’s hard to pick up a copy of The New York Times or the Washington Post these days without encountering at least one article on the topic.

Obamacare Surprises For Taxpayers

One of the nation’s leading health care economists says the health reform law has some hidden surprises for people filing their income tax returns today.