Larry Kotlikoff’s Commentaries

Social Security Benefits: Heads They Win, Tails You Lose

House Republicans – Raise the Debt Limit, But Stick to Your Fiscal Guns. Our Country Is Dead Broke!

Our country’s fiscal gap is 7.7 percent of GDP. This means we need to collect 7.7 percent more in taxes, every year starting now, to cover all the future spending the CBO projects. Alternatively, we need to immediately and permanently lower the path of federal spending by 7.7 percent of each future year’s GDP. Or we can do neither of these things and dig an even deeper hole for our kids. More

Social Security’s Massive Malfeasance

Should You Now Wait Till 75 To Take Your IRA?

Are US retirees foregoing large sums of Social Security benefits?

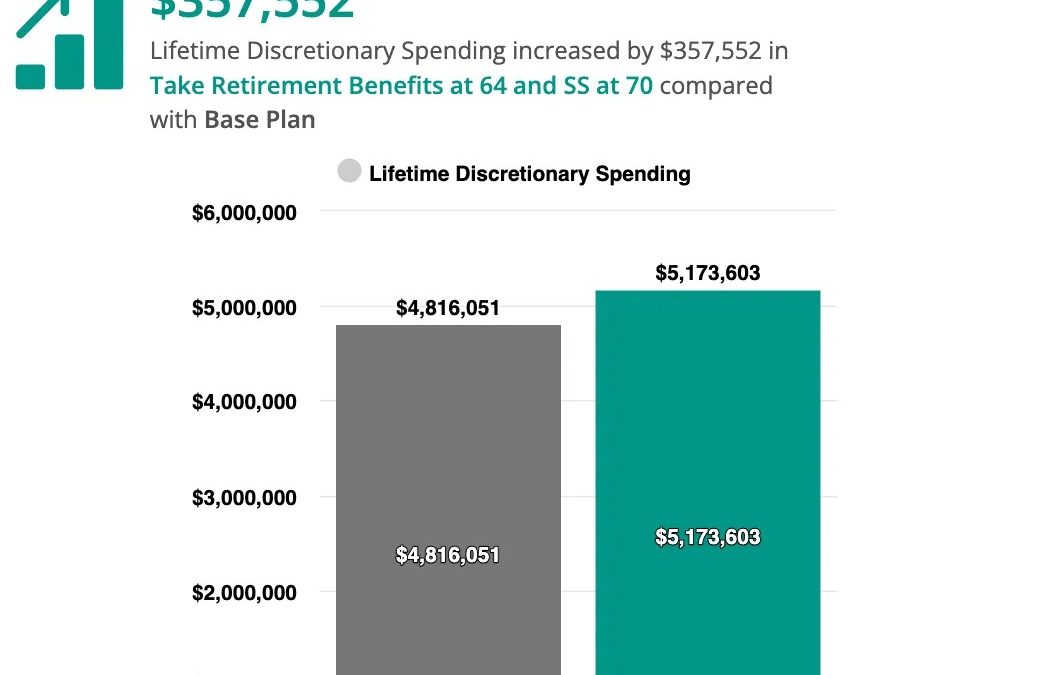

90% of Americans are likely to benefit if they wait until age 70 to claim their Social Security benefits. Yet only 6% do so. If you add up the loss of benefits from these decisions over the remainder of a retiree’s lifetime, the typical retiree is leaving $182,370 (in present-value terms) on the table by claiming benefits too soon. More

Social Security COLA Still Fails To Keep Up With Inflation

The COLA is supposed to keep our (I’m also a recipient) benefits even with inflation. Unfortunately, it doesn’t. The COLA is calculated based on the rise in the Consumer Price Index between September 30th and October 1st of the previous year. Hence, we’re getting compensated for past annual inflation, with a three-month lag to boot! This leaves us perpetually behind the eight ball. More

The US is a Waning Economic Superpower

The U.S. is a waning economic hegemon. But far too few Americans, including politicians, realize this. The eventual new and very big kid on the block is, under all but extreme scenarios, China; and, after China, India. By 2100, the U.S. will be in third place, when ranked by GDP — producing only 12 percent of global output compared with China’s 27 percent and India’s 16 percent. More

The Republicans Need Their Own Student Loan Reform. Here It Is.

President Biden just canceled a mother-load of student debt. The income limit for the President's largess is $125,000 for individual borrowers and $250,000 for married and heads of households. Those below these limits received up to $10,000 in debt forgiveness. And...

Finally, A Safe Way To Play The Market — Upside Investing

Upside Investing represents a revolution in investment/spending strategy. It lets you set a living standard floor that only rises as a result of investing in stocks and other risky assets. The higher your floor, the lower your upside and vice versa.

Inequality has been Greatly Exaggerated

A new study by Goodman Institute Senior Fellow Laurence Kotlikoff and his colleagues says that middle-aged families in the top fifth of the income distribution have almost 200 times the wealth of families in the bottom fifth. But after taxes and entitlement transfers, the difference in lifetime spending power is only 7.5 to 1. Our fiscal system is far more progressive than critics like to admit. See the New York Times description and the technical paper.