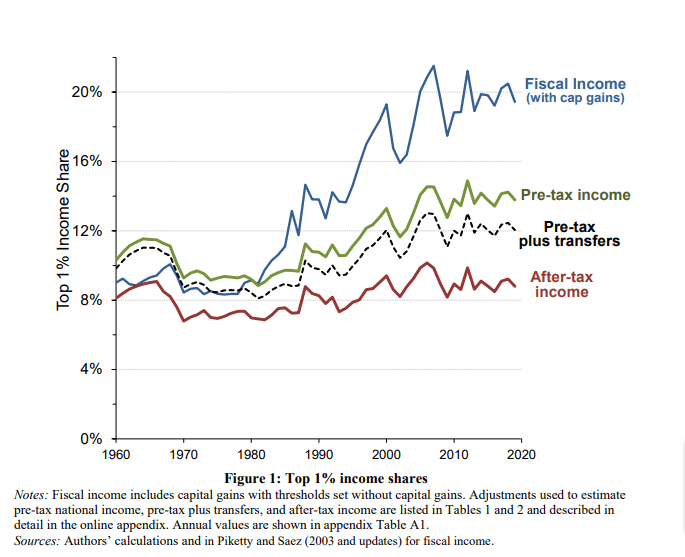

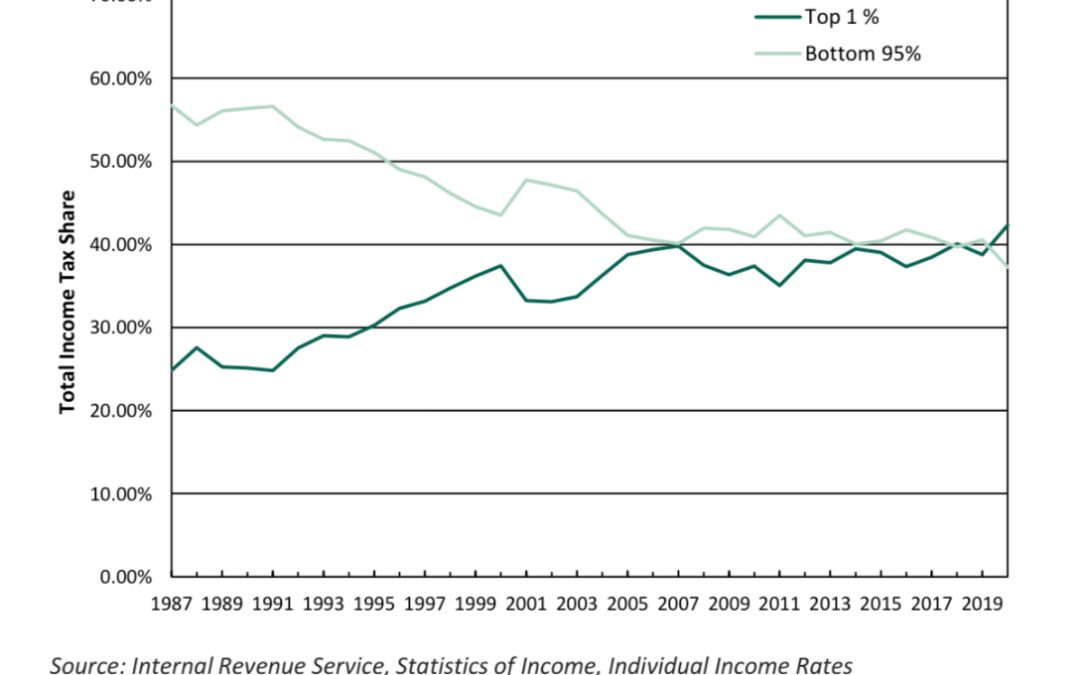

The Piketty-Saez-Zucman estimates show a substantial increase in the share of national income going to the top 1% of income earners. But these estimates ignore government taxes and transfer payments.

Yet a new study finds that the share of after-tax income earned by the top 1% has not changed since the 1960s.