If no policies are changed, in just ten years 66 million Social Security beneficiaries will see their monthly benefit checks cut by 23 percent. That will be financially devastating for retirees at the bottom of the income ladder – who depend on Social Security for their entire income – and it will double the number of seniors in poverty.

At the same time Medicare payments to hospitals will be automatically cut by 10 percent. That will make seniors, especially low-income seniors, less attractive as patients and lead to rationing of medical care.

As time passes, these financial problems will become increasingly worse. They will spill over and affect every social insurance program – Medicaid, food stamps, housing subsidies, etc.

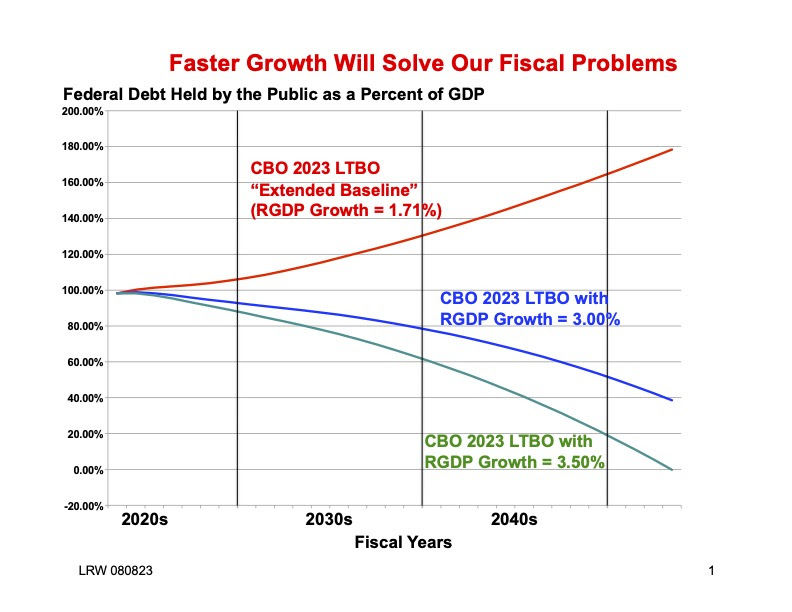

The chart above shows the Congressional Budget Office (CBO) Long Term Budget Outlook (LTBO). The word “baseline” means the path we are on. As the chart shows, if there are no policy changes, the debt relative to our national income will continue to grow. Eventually, we will have to severely cut social safety net programs or face bankruptcy.

An affirmative plan that expands social safety net spending – not only meeting current commitments, but adding to them – and funding that spending by taking money out of the capital market (“taxing corporations” or “taxing the rich”) will almost certainly lower our growth rate and make it even more difficult to meet the needs of those at the bottom of the income ladder. Slower growth will almost certainly make the poor poorer in future years.

[Remember: increasing capital per worker, raises the output per worker (productivity) and higher output per worker is mainly what we mean by economic growth. (See the summary here.)]

Now consider an alternative strategy. Suppose we lower taxes on investment income, in order to encourage more investment and achieve a higher rate of economic growth. As the chart shows, if we are able to double the rate of growth – achieving something close to the country’s historic average — we could eliminate our federal debt entirely by midcentury!

One sentence above bears repeating:

An affirmative plan that expands social safety net spending – not only meeting current commitments, but adding to them –

It is not enough for the affirmative to propose taxing the rich and giving to the poor. They have to find a way to maintain the current level of safety net spending and add to it – in order to meet the apparent intent of the resolution.

0 Comments