What’s New

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.

Biden v. Medicare Advantage

Leftists in Colorado Seem Poised to Try Again for Single Payer Health Insurance

Last time around, the idea was rejected by almost 79% of the voters. And for good reasons. British Columbia’s single payer system is so mismanaged it pays for cancer patient radiation treatments in Bellingham, Washington. Its hip replacement wait can be almost a year… Because Canadian patients wait twice as long as recommended for MRI scans, those who can afford it pay cash for quick service at US imaging centers in border cities like Buffalo, NY and Bellevue, WA. More.

Two Cheers for the Bipartisan Tax Deal

A rare bipartisan agreement in Congress would create a larger child tax credit for parents and extend some key business tax breaks in the 2017 (Trump) tax reform bill that have expired. Democrats are said to favor the former and Republicans the latter.

Opinions on the accord are all over the map, with pros and cons – both on the right and the left. I give it two cheers. If it were funded by reducing means-tested welfare spending, I would give it a third cheer.

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

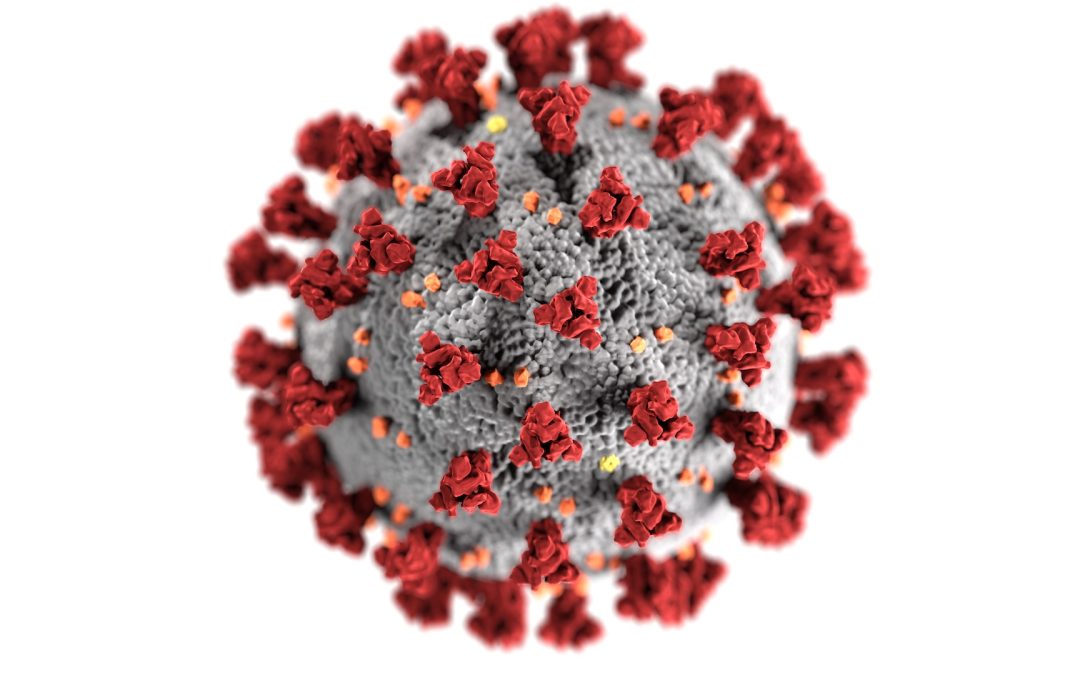

How the FDA Misled Us During the COVID Pandemic

COVID-19 is steadily attracting less attention, which is welcome news. Before we put the pandemic behind us, however, we should learn important lessons so we can avoid repeating mistakes. One catastrophic mistake is that the Food and Drug Administration (FDA) perpetrated misinformation that probably killed hundreds of thousands of Americans. Unless steps are taken to rein in the FDA’s powers, similar results are likely to happen in the future.

Julian Simon, Vindicated Again

Each year, the Competitive Enterprise Institute (CEI) has a dinner in Washington, D.C., honoring the economist Julian Simon, who died in 1998. Simon was a rare optimist in the fields of population and natural resources. He disagreed with most environmentalists of his day (especially in the 1980s through 1990s). They feared passionately that growing population would overwhelm agriculture and industry and that the world would run out of natural resources such as oil and minerals.

What Companies Using AI Need To Know About The Sam Altman Reshuffle

Turmoil is rocking the artificial intelligence industry. Business leaders developing an AI strategy should—in most but not all cases—continue as before the recent big news.

The board of OpenAI fired Sam Altman as CEO on November 17, and the company’s president, Greg Brockman, resigned soon after. Three days later, Microsoft announced, “Sam Altman and Greg Brockman, together with colleagues, will be joining Microsoft MSFT -1.2% to lead a new advanced AI research team.”