Paying attention to total national health care spending, not whether it’s called public or private, is what’s important.

Under our current Balkanized, four-part (employer-provided, Medicare, Medicaid and ObamaCare) health care system, total national health care spending has grown to a gargantuan 18 percent of GDP. Yet our health care system still leaves almost 30 million Americans uninsured and almost 60 million underinsured.

Other high-income countries, including Germany, France, Switzerland, Sweden, Japan and Canada, spend less than 12 percent of their GDP on health care, while providing uniform high-level health care to all. Thanks to the staggering, one-in-four number of Americans who are uninsured and underinsured, our country has pitiful health care outcomes. This includes the lowest life expectancy and the highest infant mortality of any high-income country.

If the cost of the current health care system wasn’t bad enough, the Congressional Budget Office (CBO) projects a 4 percentage-point of GDP rise in federal health care spending by mid-century. If private health care spending rises at the same rate, which has been the rule, we’re looking at spending one quarter of GDP on health care by 2050 and still leaving a quarter of the population in the proverbial health care ditch.

Keeping this system going or Balkanizing it even further, as South Bend, Indiana, Mayor Pete Buttigieg proposes, is a prescription for economic doom. If our country is perpetually spending a quarter of GDP on health care and other leading economies are spending half that share, they, not we, will be able to afford all manner of investments in education, infrastructure, basic research, and the like, that are critical to long-term growth.

As it is, the part of our national health care spending that’s called public has left the federal government with a massive fiscal gap. The fiscal gap, which puts all future obligations, official and unofficial, on the books is the present value difference between projected outlays and projected receipts.

I’ve calculated the U.S. fiscal gap using projections through mid-century from the CBO as well as extrapolations beyond 2050 of their projections. Brace yourself. Uncle Sam’s fiscal gap is now $239 trillion, i.e., 10 years of GDP. Eliminating our current fiscal gap requires either a 50 percent immediate and permanent hike in all federal taxes or a 33 percent immediate and permanent cut in all federal outlays apart from debt service. The longer we wait, the larger the requisite tax hike or spending cut.

Thus, MFA raises two questions. Would it raise national health care spending as a share of GDP? And would it worsen the fiscal gap?

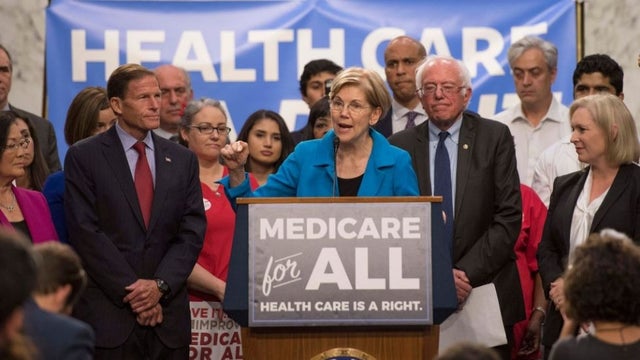

According to the Urban Institute, MFA would raise the national health care spending share of GDP by 13 percent were it implemented immediately. Sen. Warren disagrees. She says her MFA plan would slightly lower the share. The Mercatus Center seems to agree with the senator. The big question, though, is whether MFA would stabilize the health care spending share at its current 18 percent or slightly higher value. If it does, then the fiscal gap will be dramatically reduced. Why? Two reasons.

First, Warren just released her plan for new taxes to collect the extra money needed to cover the health care spending that will be done under MFA by Uncle Sam rather than by ourselves and our employers. This means that the switch to public from private payment won’t, if we take Warren’s estimates as correct, increase the fiscal gap.

Second, if national health care spending is kept at 18 percent of GDP, we won’t experience what the CBO projects will happen under the current system — a 4 percentage points of GDP increase in federal health care expenditures for which there is no proposed additional tax funding.

In short, the introduction of MFA, with its extra outlays covered by extra taxes and total federal health care outlays fixed permanently at today’s 18 percent share of GDP would make a huge dent – probably 40 percent – in our fiscal gap.

Controlling total national health care spending is essential to getting back onto a path fiscal solvency. And MFA is the only system that can make that happen because it’s the only system that gives Uncle Sam direct control of national health care spending.

Stated differently, MFA affords us the ability to set a national health care expenditure budget and makes it easy to check if we’re sticking to it. Consequently, Warren and Sanders ought to add to their plans three simple stipulations, which should silence their fiscal detractors.

1) Under Medicare for All, national health care spending paid by government will never exceed 18 percent of GDP.

2) The Treasury will do fiscal gap accounting to ensure that Medicare for All does not worsen America’s fiscal gap.

3) Congress will be encouraged to adopt fiscal measures that eliminate our fiscal gap.

Fiscal gap accounting is long overdue. All 28 members of the European Union are doing fiscal gap accounting on a regular basis to ensure their fiscal policies are sustainable.

But back to MFA, particularly my major concern with the Sanders-Warren version. How can the government control expenditures under their MFA plan if participants can see as many doctors per day as they’d like, not pay a penny and have all the bills sent to Washington? The answer is they can’t and that MFA utilization needs to be controlled in some manner. Otherwise, doctors will have an incentive to see their patients on a daily basis and turn the system into personal money machines. This is the big concern with the senators’ plans.

If utilization goes nuts, one of two things will happen. Either Congress will need to cut doctor reimbursements, which would lead honest doctors – those who aren’t trying to milk the system – to seek alternative careers. Or doctors will get paid a fixed amount regardless of how many patients they see or how many visits they schedule. This is the UK and French solution. Doctors are state employees. The hospitals also are nationalized to ensure they don’t over-treat patients and over-charge the system.

It’s not the worst outcome. But such a major shift in health care provision may be a bridge too far for the U.S. public and their representatives in Congress. This is one of the many reasons I’ve been pushing Medicare Advantage for All (MAA). It features government-paid, private provision of health care by Health Maintenance Organizations (HMOs), no incentive to cherry pick because the payment to the HMO is based on the participant’s pre-existing condition (meaning HMOs can make as much income on sick as on healthy participants), lets employers keep their plans provided they allow non-employees to join and has a simple means of keeping health care spending within the national health care expenditure budget.

Sanders and Warren should abandon their “My way or the highway” approach to enacting MFA and signal that they’re open to considering Medicare Advantage for All, which, incidentally, is the Republican-initiated alternative to traditional Medicare and the Medicare system of choice for one third of current Medicare beneficiaries.

Medicare Advantage, as now structured, is far from perfect. But these problems largely arise from participants cherry-picking — switching from their Medicare Advantage plan to traditional Medicare when they get really sick. Under Medicare Advantage for All, this would no longer be possible.

0 Comments