A new study shows that the benefits of tax reform vary widely – and state taxes are the most important reason.

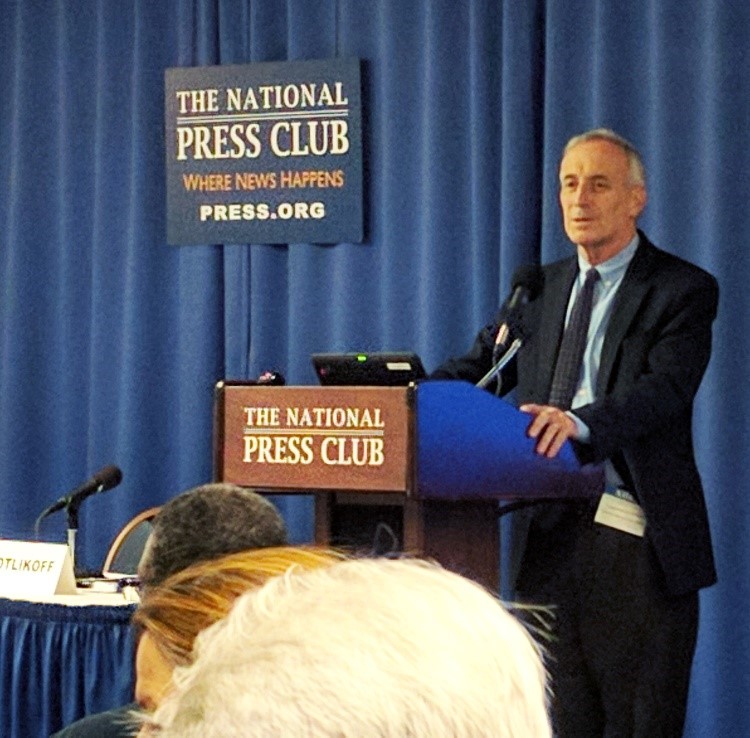

The study is produced by Boston University economist and Goodman Institute Senior Fellow, Laurence Kotlikoff, together a team of other economists, many based at the Federal Reserve Bank of Atlanta. The paper, posted on the Atlanta Fed’s website, concludes that:

- The average household in America can expect a lifetime gain of $25,322 from the tax reform law, measured in current dollars.

- The gain varies from a high of $40,998 in Washington state to a low of $17,888 in Vermont.

- The most important reason for differences among the states is a new, $10,000 limit on the deductibility of state and local taxes.

These estimates capture just the impact of the reform’s changes in tax provisions. It doesn’t include improvements in the economy as well as personal incomes that the reform has or will produce. In other co-authored work, Kotlikoff estimates that economic expansion spurred by the reform will more than double the benefit for most people.

The study is a first-of-its-kind estimate of the lifetime effects of the state-level impact of the new tax law – projecting how individuals will fare, right up through their retirement years. The study not only estimates how state and federal taxes interact for people at different ages and income levels, it also estimates how the changes will interact with Social Securely, Medicare and our plethora of other federal and state benefits.

State taxes are the main reason why residents of some states have two to three times the gains of households in other states. For example:

- Among the ten states where the average household has the highest gain as a percent of lifetime income, seven have no state income tax.

- By contrast, the five states where the average household gets the lowest benefit from tax reform have some of the county’s highest state income tax rates.

In California, where income can be taxed at a top rate of 13.3 percent, the gain from tax reform for the average household is $21,548. In Texas, with no income tax, the gain is $31,124. However, if there were no limit on the deductibility of state and local taxes, Californians would have done better than Texans under the new law.

In general, high-tax states, which tend to be Democratic, had smaller gains than low-tax states, which tend to be Republican. For example:

- Among the 12 states where the average household has the smallest gain from tax reform, 10 are reliably blue states in presidential elections.

- Among the 10 states where the average household had the highest gains from tax reform, half are reliably red states in presidential elections

0 Comments