By John C. Goodman and Laurence Kotlikoff

This article was originally posted at Forbes, August 2017

A plan to radically reform the US income tax system has been proposed by House Speaker Paul Ryan and House Ways & Means Chairman Kevin Brady. On the personal side, the system would become simpler, fairer and flatter. On the corporate side, the current system would be replaced by a cash flow tax, similar to a value-added tax with a carve out for wages.

The new system would remove the incentive of US companies to send investment dollars and jobs overseas. As a result, there could be a massive inflow of capital – that would significantly raise productivity and wages for workers at all skill levels.

Boston University Prof. Laurence Kotlikoff and Berkeley economist Alan Auerbach are two of the intellectual sources underlying the Republican proposal. Indeed, the business part of the proposal closely resembles a corporate tax reform developed by Auerbach in 2010. Both economists are nonpartisan.

Prof. Kotlikoff recently completed two studies of the plan via The Fiscal Analysis Center. (The Goodman Institute helped establish The Fiscal Analysis Center and helps fund it on an ongoing basis.) The first study, with Auerbach and Darryl Koehler was released in May. It focuses on the tax reform’s progressivity.

A second study, with Seth Benzell and Guillermo Lagarde was just released. It simulates the dynamic economic feedback effects of the House tax plan, using a state-of-the-art global model of economic growth, fiscal policy, and demographic change. The model, called the Gaidar Global model, was built with a team of economists from Moscow’s Gaidar Institute. It features 17 large countries or combinations of countries, which span the entire global economic system. Despite its over 3 million equations, the results are easy to understand and make full economic sense.

Here are some results for the US economy from the two studies.

- There is no give away to the rich: the distribution of resources under the reform is “almost as fair” as the current system.

- There are no huge deficits: in fact, the plan gains revenue for the government.

- There is a boost in wages: about $4,000 in additional wage income in the near term for the average household and larger gains in future periods.

What follows is a summary of the key elements of the proposal, with special attention to three particularly controversial provisions: (1) border adjustment of the corporate tax, (2) no interest deduction for business borrowers and (3) no deduction for state and local taxes for personal borrowers. Each of these provisions has a budget impact of roughly $1 trillion over the next ten years.

The Case for Change: Complexity and Compliance Costs. The problems with the federal income tax system are well known and well documented. As the Better Way tax reform proposal makes clear:

While the Internal Revenue Code runs over 2,600 pages, the tax code itself represents only a small fraction of the entire body of Federal tax law. Taxpayers must navigate laws and guidance that include Treasury regulations; IRS forms, instructions, publications and other guidance; and Federal court decisions. When all of these sources are compiled together, the Federal tax laws today fill approximately 70,000 pages – almost triple the number of pages at the time of the Tax Reform Act of 1986.

To give but one example, even a concept as simple as “married” takes 218 words and five paragraphs to define. Small wonder, then, that Americans now spend over $409 billion and 8.9 billion hours annually trying to comply with the tax code.

Things are made worse by deductions, loophole and subsidies that favor some activities over others. For example, the deductibility of mortgage interest and property taxes encourages an overinvestment in housing at the expense of more productive uses of capital in our economy. These tax preferences, referred to as “tax expenditures,” amounted to more than $1.4 trillion in 2016, or almost three-fourths of the amount of revenue raised by the entire Federal income tax.

The Case for Change: Encouraging the Export of Capital and Jobs Over Seas. Since the turn of the century, Canada and Ireland have cut their corporate tax rates in half. Britain and Denmark have cut their rates by about one-third. In fact, every developed country has cut its corporate tax rate in recent years with one exception — United States. Other countries are responding to an inescapable fact about globalization: It is increasingly easy for capital to go where it is treated the best.

At 35%, our top federal corporate tax rate has not changed in 17 years. When state and local taxes are added, the rate tops out near 40% –making ours the highest statutory corporate tax rate in the world. Yet the amount of revenue the federal government collects from corporate taxation is only 2% of GDP, one of the lowest collection rates among developed countries.

We collect the least taxes with the most pain. That may be one reason why the United States is losing out in global competition. In 1960, 17 of the 20 largest global companies were headquartered in the United states. By 2015, only 6 were headquartered here.

Even if companies don’t leave, the tax law encourages them to park their capital offshore. American companies have an estimated $1.3 trillion in overseas cash. That includes $230 billion held by Apple Inc and $113 by Microsoft Corp. As long as these companies keep their resources offshore, they can invest them in US stocks, bonds and Treasury bills and avoid paying the high US corporate tax rate until the funds are repatriated.

We not only discourage American companies from bringing their capital home, we discourage foreign companies from investing here as well.

Making the Personal Income Tax Simpler, Fairer and Flatter. The Better Way proposal would abolish a raft of deductions, exemptions, credits and other complications in the tax code. The proposal:

- Replaces the current system’s five tax brackets with three brackets: 35%, 25% and 12%.

- Eliminates all itemized deductions other than mortgage interest and charitable contributions.

- Creates a larger standard deduction and a larger child tax credit.

- Eliminates the alternative minimum tax

- Eliminates the estate and gift tax.

- Excludes half of interest, dividend and capital gains income from taxation.

- After an allowance for reasonable imputation of wage income, subjects small business pass through income to a maximum 25% tax.

Replacing the Corporate Income Tax with a Business Cash Flow tax. The proposal would abolish the current corporate income tax and replace it with a cash flow tax that:

- Taxes corporate “cash flow” income at a flat rate of 20%.

- Allows immediate 100% expensing of all investment.

- Allows the deduction of wages.

- Removes the deduction for any net interest expense.

- Removes the alternative minimum tax.

- Removes all special interest deductions and credits, but keeps the R & D tax credit.

- Allows a 100% exemption for dividends from foreign subsidiaries.

- Allows foreign earnings accumulated under the old tax system to be repatriated at rates of 8.75% and 3.5%.

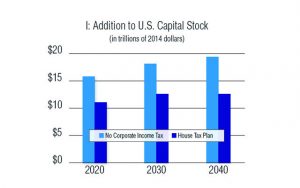

Impact on Capital. Benzell, Kotlikoff and Lagarde find that the change in the structure of the corporate income tax would have an immediate effect on capital flows. In the near term the US capital stock would increase by almost 20%, or $11 trillion. These results are shown in Figure 1, which also shows the impact of eliminating the corporate income tax completely. In the latter case, the US capital stock would increase by roughly 25% in the short run and by almost $20 trillion by the year 2040.

Addition to U.S. Capital Stock

These large increases in capital occur, not because US citizens would be saving more, but because of the inflow of capital from around the world. Unlike labor, capital flows quickly in response to tax changes. Moreover, more capital means higher productivity and higher wages.

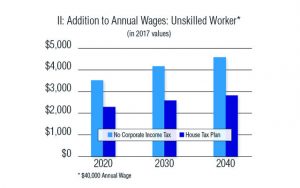

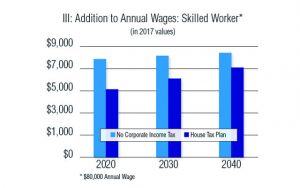

Impact on Wages. How the Better Way tax reform affects wages through time is shown in Figure 2 and Figure 3:

- Without any change in policy, wages are predicted to fall in the decade ahead.

- With tax reform, low-skilled workers get a 5.7% wage boost in the near term, rising to a 7.9% boost by 2040.

- For a $40,000-a-year worker, this means a boost in pay of more than $2,000 a year – rising to almost $3,000 by 2040

- For an $80,000-a-year worker, annual pay would increase about $5,000 — rising to $7,000 by 2040.

- If the corporate income tax were abolished entirely, wages for this high-skilled worker in would be about $8,000 higher than otherwise.

Addition to Annual Wages: Unskilled Worker

Addition to Annual Wages: Skilled Worker

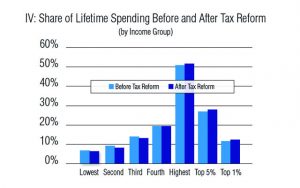

Impact on Inequality. Since previous research finds that burden of the corporate income tax falls on workers, the Ryan/Brady bill does something that may surprise many Republicans and Democrats: It effectively replaces a tax on labor with a tax on wealth. This means that the Better Way tax plan is a very progressive tax reform.

The Business cash flow tax is structurally equivalent to a value-added tax (VAT) with a carve out for labor income. A VAT taxes all consumption, whether paid for out of wages or wealth. But the tax on the component of consumption paid out of wages is largely offset by the fact that wages are excluded in assessing the tax. Hence, moving from the U.S. federal corporate income tax to a business cash flow tax with a carve out for wages moves us from indirectly taxing wages to primarily taxing wealth (i.e., consumption purchased out of wealth).

In rejecting the idea that the tax plan is a tax cut for the rich at the expense of the middle class, Auerbach, Kotlikoff, and Koehler compared the effects of the plan on lifetime consumption for people in their forties. The share realized by the bottom fifth of the income distribution barely moves — falling from 6.3% percent of the total for the group to 6.1%. At the other end of the spectrum, the share realized by the top 1% also barely moves — rising from 11.5% to 11.6%. The reformed distribution between these two extremes looks pretty much as it does today. (See Figure 4)

Share of Lifetime Spending Before and After Tax Reform

Other Country Reponses. A natural question to ask is: If the US reformed its tax system, would other countries sit idly by and let capital from their countries flow into ours, or would they respond with tax reforms of their own? The economists modeled this possibility by assuming that US tax reform is matched by all foreign governments. Interestingly, the result is not a complete stalemate.

With tax reform occurring in every country, the entire international capital market becomes more efficient. With more efficient use of capital, wages tend to rise in every country – other things equal. And because the US tax system creates the most inefficiency, if the world capital market becomes efficient, the US will benefit from a capital inflow. US workers will enjoy higher wages as a result.

In particular, with tax reform matching all over the world, the US capital stock would still be 9% higher than otherwise in 2020 and 15% higher by 2040. As a result, the wages of skilled and unskilled workers in 2040 would be 8.4% and 5.5% higher than otherwise, respectively.

Border Adjustment. A controversial aspect of the Better Way tax plan is the way it treats imports and exports. Since the idea is to tax domestic consumption, imports need to be subject to the same tax as domestically-produced consumer goods. On the other hand, there should be no tax on goods that are exported. This is a destination-based approach to international transactions. Consumption taxes are levied in the country in which the consumption takes place.

Most states in the United States have border adjustment. For example, Maryland has a 6% sales tax that applies to imports but not exports. A tee shirt purchased there is subject to the tax – whether it is produced in Maryland, Delaware or China. But tee shirts produced in Maryland and sold to out-of-state buyers are not subject to the tax.

Critics claim that border adjustment will make imports more expensive than they otherwise would have been, tilting the tax law in favor of domestic production – much like an ordinary tariff. However, there are about 34 developed countries with a value-added tax and they all have border adjustment. Moreover, there is no evidence that border adjustment affects trade. In general, adjustments in exchange rates offset the border adjustments, leaving domestic price ratios roughly where they were before the imposition of the value-added tax.

Finally, border adjustment would end the current incentives to game the tax system. Suppose Apple has a subsidiary in low-tax Ireland. Under the current system, it can shift profits to the Irish subsidiary by overcharging for its exports and undercharging for its imports to and from the subsidiary. Under border adjustment, this incentive goes away, because exports are not included in its tax base and imports are not deductible, regardless of their cost.

Interest Deductibility. There are essentially two ways of supplying capital to a firm – with debt or with equity. The tax law is not indifferent between these two choices, however. Interest payments are deductible for federal income tax purposes while dividend payments are not. His practice encourages companies to become overly leveraged. Moreover, if investments are immediately expensed, as they would be under the Better Way tax plan, the deductibility of interest results in a “negative tax,” under which there is a tax advantage for investing. This could encourage firms to make investments that would otherwise be uneconomical.

Removing the deductibility of interest puts debt and equity on a level playing field, removes the incentive to become overly leveraged, and avoids encouraging uneconomical investing.

Deductibility of State and Local Taxes. This is one of our personal tax system’s major loopholes. It’s also highly regressive, since the poor and most of the middle class take the standard deduction and aren’t able to deduct their state and local (primarily property) taxes. The provision also biases consumption and investment toward housing. Advocates of this deduction have some valid counterarguments. But if we are ever going to simplify our complex federal personal income tax system and make it more efficient, including providing people larger incentives to work, we need to broaden the personal income tax base and eliminate loopholes.

This article was originally posted at Forbes on August 10, 2017.

0 Comments