Goodman Institute economists Lawrence Kotlikoff and Alan Auerbach were the brains behind tax reform (Tax Cuts and Jobs Act of 2017). Much of what they recommended became law, including a reduction in the top corporate income tax rate from 35% to 21%.

The economists predicted that a large inflow of capital from abroad, increased investment, higher output and higher wages would result. They also estimated that the new tax code would be just as progressive (or more so) as the one it replaced. Although the coronavirus has clearly slowed things down, more than $1 trillion in capital has been repatriated by U.S. companies.

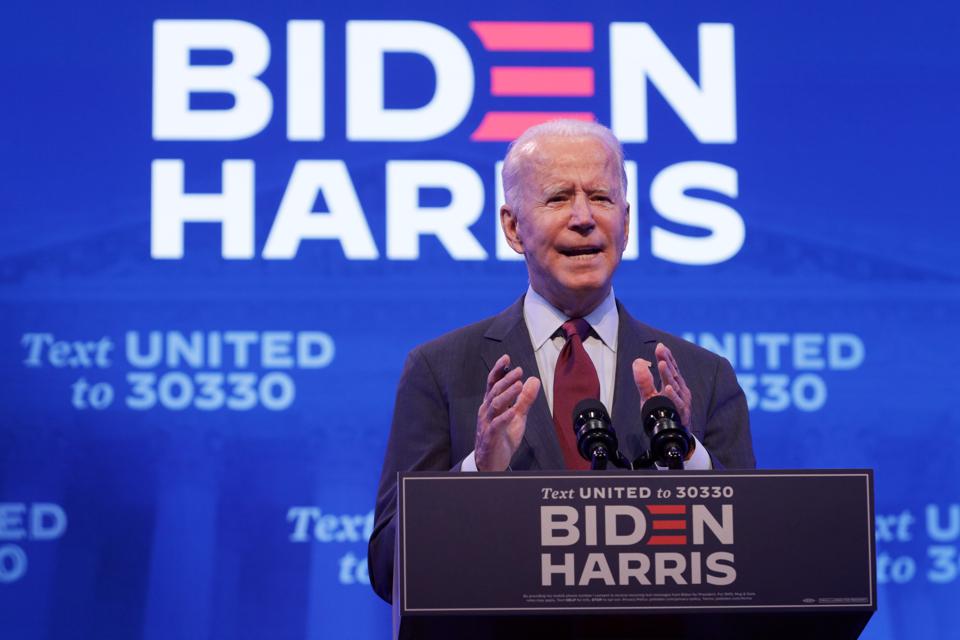

Presidential candidate Joe Biden is proposing to raise the corporate tax to 26%. His running mate, Kamala Harris, would like to push the rate all the way back to 35% – giving us the highest corporate profit tax rate in the world. Virtually every reputable economic modeling group predicts that higher corporate taxes are a burden for every income group – despite Biden’s claim that no one with an income below $400,000 would be affected.

The Congressional Budget Office and most private modelers assume that 25% of the corporate tax falls on labor and 75% falls on owners of capital. However, Kotlikoff and his colleagues, using the most sophisticated model of international capital flows ever developed, estimate that virtually all of the corporate tax is paid by labor. This implies that corporate taxes are actually quite regressive.

A tax on corporate profits, in other words, is a tax on labor, not a tax on capital.

In a study with economists at the Atlanta Federal Reserve bank, Kotlikoff and Auerbach estimate that the average household in the United States can expect a lifetime gain of $25,000 because of the 2017 tax reform act. Depending on how much of the act is repealed, moderate-income households have a lot to lose.

A number of other policy proposals are surprisingly illiberal. For example:

- Biden proposes to subsidize the (Obamacare) premiums of the 40% of higher-income families who currently get no subsidy in the health insurance exchanges. As a percent of income, wealthy buyers would get the same help from government as the near-poor.

- He proposes to lower the age of eligibility for Medicare to 60. Yet according to the most recent Current Population Survey, this age group has above-average income and above-average wealth. Moreover, of the almost 30 million people in the United States who are currently uninsured only about 1.7 million are seniors. If these people buy their own health insurance and have below-average incomes, they already are entitled to the same subsidies everyone else gets. If they make too much income to qualify for subsidies under current law, they face premiums that are kept artificially low. In fact, relative to actuarially fair premiums, this age group is the most favored of all.

- He proposes to make the first two years of community college tuition-free. Yet there is probably no single factor that explains inequality better than the possession of a college degree, and the gap between the income of college graduates and non-college graduates has been growing over time. In addition, students from low-income families who attend college are already paying almost no tuition.

- He proposes to reverse the Trump administration’s progress on deregulation. Yet, Casey Mulligan (University of Chicago economist and former member of the Council of Economic Advisors) estimates that the economic effects of regulation are very regressive. The cost of Biden’s regulatory burden would equal 15.3% of income for the bottom fifth of the income distribution, but only 2.1% for the top fifth.

- Although not included at his website, Biden has given vocal support to removing the cap on the deductibility of state and local taxes, and this is a high priority for Democrats in Congress. Yet Brookings Institution economists estimate that this one tax change would be more valuable to the rich than the rest of the 2017 tax reform package combined.

All that said, the Biden economic plan does call for new taxes on the rich, claiming that they don’t pay “their fair share.” One wonders what a fair share would be? The top 1 percent of income earners in the United States already pay 38.5% of all income taxes. The top 10 percent pay 70%. And the U.S. currently has the most progressive income tax system in the world.

The puzzle in all this is, Why? Why impose a whole slew of new taxes on the rich and then turn around and give them a whole slew of new benefits?

What’s missing here is any morally defensible public policy purpose – what George H. W. Bush once called “the vision thing.”

0 Comments