Although widely reported in the national news media, the claim that most of the benefits of tax reform are going to the wealthy is wrong according to economists whose ideas were used in shaping the legislation that was enacted last year.

In a report for the Goodman Institute, Boston University economist Laurence Kotlikoff says that under the new tax regime, the top 1 percent of income earners will actually bear a larger share of the tax burden than they did under the previous system.

“There was no give-away to the rich,” he said. “If anything, the tax system has gotten slightly more progressive.”

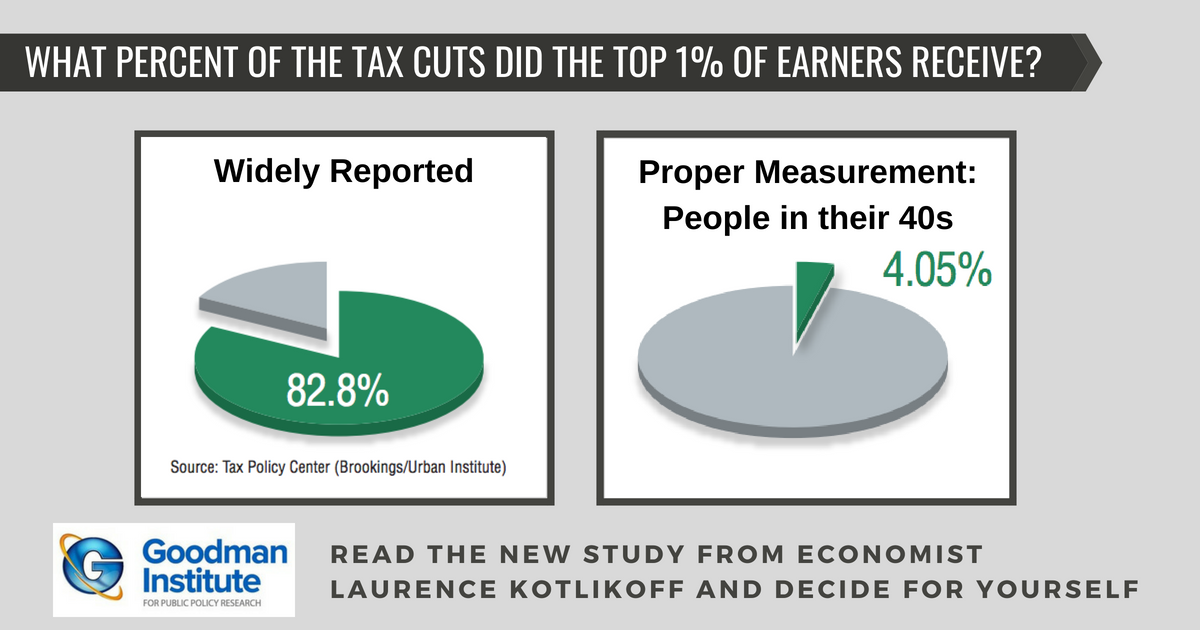

The Tax Policy Center (sponsored by the Brookings Institution and the Urban Institute) says that 82.8% of the benefits of tax reform will accrue to the wealthiest taxpayers. But according to FactCheck.org, that claim is more than misleading. The Center’s own numbers show that if the individual tax cuts are made permanent, the share going to the top 1 percent will receive 25.3% of the benefits. And most people in Washington think the tax cuts for individuals will be made permanent.

But Kotlikoff says that “Even if the tax cuts are not made permanent, the Tax Policy Center is way off the mark. Among 20-year-olds, only 4.05% of the benefits would go to the top 1 percent. Among 40-year-olds, the share would be only 6.54%.”

Kotlikoff says that the center (and other economic organizations) are using tools that are decades old and out-of-date. Among the mistakes they make are:

- Looking only at income and ignoring wealth.

- Focusing only on current income and ignoring how the tax law affects people over an entire life cycle – from entry level wages to peak earnings to retirement.

- Treating people who have the same current income as though they are the same, regardless of age – whether they are 20 or 50 or 80 years old.

- Ignoring the interaction of tax law changes and 7 major entitlement programs, including Social Security and Medicare.

New methods available to economists do not make these mistakes, according to Kotlikoff. A study he and his colleagues have completed concludes that:

- Among people in their 20s, 52% of the benefits of tax reform will go to the broad middle class.

- Among people in their 40s, 42.8% of the benefits will go to the middle class.

“The life time benefits from tax reform will be worth more than $20,000 for an average-income, average-age household, even if there is no economic expansion,” according to Kotlikoff. “With the economic expansion we predict, the benefits will be between $60,000 and $70,000.”

See more of the study: https://www.goodmaninstitute.org/study-83-of-the-tax-cut-did-not-go-to-the-very-rich/

0 Comments