2017 Third Quarter in Review

Dear Friends of the Goodman Institute,

Unveiling a first-of-its-kind tax model at the National Press Club. Presenting new and bold opportunities for Health Savings Accounts on Capitol Hill. Producing a state-of-the-art analysis of Donald Trump’s plan for corporate tax reform. Proposing a win/win strategy for privatizing social insurance to an international gathering of intellectuals. Advancing an alternative to Obamacare. Opposing single-payer health insurance in Colorado. These are some of the few activities that highlight a very active third quarter.

Tax Model Unveiled at the National Press Club

The room was packed as Boston University economics professor Laurence Kotlikoff prepared to address them on September 21st. In attendance were economists from the Treasury, the Congressional Budget Office, the Congressional Research Service, Washington, DC think tanks and the staff of the tax writing committees on Capitol Hill. They came to witness something economists had never seen before.

What Kotlikoff unveiled were the results produced by himself, UC Berkley economist Alan Auerbach and two of their colleagues: a calculation of the lifetime consequences of earning extra income, in light of 30 different federal and state tax and entitlement programs.

The results were stunning. In many cases the withdrawal of entitlement benefits – including Social Security, Medicare and Medicaid – are more of a disincentive to work than overt taxes.

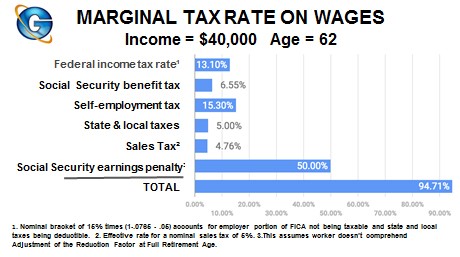

Study: Senior Workers Can Face Astronomical Tax Rates

Among the findings of Kotlikoff’s latest study is the discovery that people in their 60s who keep on working can face extremely high tax rates – much higher than the rates faced by millionaires and billionaires.

Senior workers earning an average income can easily lose more than half of their earnings to higher taxes and reduced government benefits. In some cases, workers can lose 95 cents out of each dollar they earn.

In addition to taxes on wage income, the Social Security benefits tax also imposes very high penalties on income from savings. For example, for someone in the 15% bracket for ordinary income:

- The Social Security benefits tax can increase the tax rate on pension income and IRA withdrawals from 15% to 27.75%.

- It can raise the tax on capital gains and dividend income from zero to 12.75%.

- Tax exempt income can also be taxed at a rate of 12.75%.

Goodman on Capitol Hill: Use HSAs in Every Aspect of Medicine

Health Savings Accounts have enormous potential to control costs and increase the quality of care if only the government would allow it, according to the economist who is credited with being the “father” of the idea. Goodman made his proposal at a Cato Institute briefing on Capitol Hill with Sen. Jeff Flake (R-AZ), Rep. Dave Brat (R-VA) and Cato Institute Scholar Michael F. Cannon.

To take advantage of the full potential of HSAs, Goodman says we need three policy changes: (1) HSAs need to be completely flexible, wrapping around any health insurance plan and paying for any services the plan does not pay for; (2) HSAs need to be encouraged by tax relief equal to the tax benefits of paying premiums to insurance companies; and (3) insurers should be able to deposit unrestricted amounts into a patient’s HSA without any tax penalties.

Goodman at the Mont Pelerin Society: Adopt Win/Win Policy Changes

Speaking to an overflow crowd in Miami, Dr. Goodman drew on the work of Thomas Saving, Laurence Kotlikoff and other Goodman Institute scholars to urge win/win reforms, as opposed to “eat-your-spinach” reforms, under which some people experience something distasteful. He said this is especially important if we are to ever reform entitlement programs.

The Mont Pelerin Society was founded by Milton Friedman, Friedrich Hayek and other classical liberals. More than a half dozen of its members have received a Nobel Prize.

Kotlikoff: Trump Corporate Tax Plan is a Winner

The corporate tax reform proposed by Donald Trump would result in a hefty pay raise for most American workers – about $4,000 per year for the average family.

The analysis is based on a model Kotlikoff developed with other economists – one that finds that the burden of the corporate income tax falls mainly on workers, not on shareholders.

Kudos from the Left for the Saving/Rettenmaier Medicare Reform Plan

The left leaning, Princeton health economist Uwe Reinhardt writes at Forbes, “The proposal to deal with future Medicare funding put forth by Saving, Rettenmaier and Goodman and cited by Goodman … is a serious proposal. I encourage readers to take a look and form their own opinion.”

GOP Health Reform Would be a Godsend for the States

If states are willing, people who get insurance at work and people who buy on their own could obtain it in one large, competitive market — supported by a uniform subsidy and governed by one set of rules. Also, employees could have individually owned, personal and portable insurance.

The legislation is sponsored by Rep. Pete Sessions (R-TX), Chairman of the House Rules Committee, and Sen. Bill Cassidy (R-LA).

Gorman Battles Single Payer Ballot Measure in Colorado

Gorman Battles Single Payer Ballot Measure in Colorado

Linda Gorman is almost single handedly taking on the issue – traversing the state, debating opponents, appearing on radio and TV and writing opinion pieces for Colorado newspapers. If the ballot measure passes in Colorado, expect it to become a major issue in dozens of other states.

Kotlikoff: The Social Security Deficit Just Increased by $6 Trillion

The system is now 32 percent underfunded. In other words, Social Security’s 12.4 percentage point payroll tax rate must be raised immediately and permanently by 32 percent, which is 4 cents out of every dollar we earn. Further, these revenues must be set aside and invested – not spent. The longer we wait, the higher the tax hike will have to be, which means the larger the fiscal damage our children will face.

Health Economists on the Left and Right Are Predicting an Obamacare Death Spiral

Princeton University health economist, Uwe Reinhardt, is generally viewed as a friend and supporter of the Obama administration’s efforts to reform the health care system. But now he tells Vox.com that the health insurance exchanges have “entered a death spiral and are heading toward total collapse.”

That is the same assessment Obamacare critic John Goodman renders in an editorial at Forbes. “Obamacare is experiencing two kinds of death spirals: the upward spiral of price and the downward spiral of quality,” he says.

We Have Two New Board Members

At our board of directors meeting on July 27, 2016, Leigh Curry was elected chairman of the board. We have added two new board members in addition to our current board, which includes John C. Goodman, William P. Hallman, Jr., Nan Hayworth, and R. Shane Jackson.

J. Coley Clark is co-chairman of BancTec, Inc. Clark was previously senior vice president and head of the Financial and Transportation Industry Group at EDS. Clark is a graduate of the University of Texas at Austin and served three years in the U.S. Army.

J. Coley Clark is co-chairman of BancTec, Inc. Clark was previously senior vice president and head of the Financial and Transportation Industry Group at EDS. Clark is a graduate of the University of Texas at Austin and served three years in the U.S. Army.

John Ridings Lee is CEO of North American National Risk Service, LLC. He holds degrees in business and math from the SMU Cox Business School and an insurance degree from Stanford University Business School. He is a frequent speaker on insurance matters nationally.

John Ridings Lee is CEO of North American National Risk Service, LLC. He holds degrees in business and math from the SMU Cox Business School and an insurance degree from Stanford University Business School. He is a frequent speaker on insurance matters nationally.

Your support has made the efforts above possible, and we hope you will help us continue with this vitally important work in the final quarter of 2016. If you have any questions or require any additional information, please do not hesitate to contact John Goodman by phone at 202-679-9622 or via email at johngoodman@goodmaninstitute.org.