FOR IMMEDIATE RELEASE

DALLAS, TX, SEPTEMBER 6, 2016 – The corporate tax reform proposed by Donald Trump would result in a hefty pay raise for most American workers, according to a well-regarded tax specialist who doesn’t plan to vote for him.

Laurence Kotlikoff, a Boston university economist, analyzed the Trump corporate tax plan at the request of the Goodman Institute, a Dallas based think tank. The analysis is based on a model Kotlikoff developed with other economists – one that finds that the burden of the corporate income tax falls mainly on workers, not on shareholders.

“We have one of the highest corporate tax rates in the world,” said Kotlikoff. “But we also have an array of loopholes that allow companies to escape taxation – including keeping capital off shore. That’s why the tax collects very little revenue, while driving corporations and jobs out of the country.”

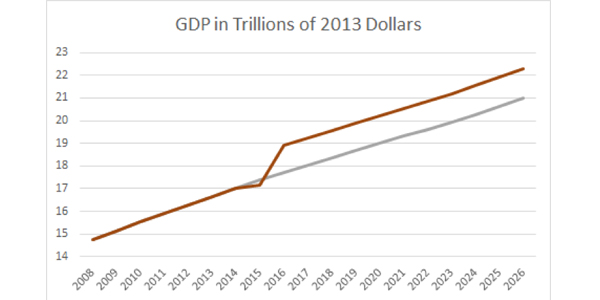

Moving from our 35 percent corporate tax rate to Trump’s proposed 15 percent rate would, he finds, produce a huge increase in capital, much of it coming from abroad.

“More capital means higher productivity and higher wages,” he said. “This kind of reform has the potential to raise the income of the typical worker by as much as $4,000 per year within the next four years.”

Kotlikoff says the Trump corporate tax reform is not a giveaway to the rich, a charge leveled by Hillary Clinton and other critics.

For one thing, the shift, if done right, would eliminate the loopholes and can, therefore, be very close to “revenue neutral.” The expansion of the economy will also produce offsetting tax increases. Kotlikoff thinks there are very few cases where tax cuts can pay for themselves, but that a corporate tax cut is one of them.

According to Kotlikoff, the primary beneficiaries of the change would be workers – not the owners of company stock.

“This is the quickest, fastest way that I can think of to raise the income of average American families,” he said. “Just ask workers in Washington State if they are better off having lost, for tax and other reasons, a goodly share of Boeing’s airplane construction to South Carolina.”

As good as the proposal is, Kotlikoff would like to see it go even further. “In the ideal world, there would not be a corporate income tax,” he said. We can have a progressive tax system with the rich paying other taxes and, thus, paying their fair share without chasing capital and jobs off shore.”

Kotlikoff is critical of other tax proposals made by Trump and Hillary Clinton, including Trump’s proposal for a 15 percent maximum tax rate on non-corporate business earnings.

___

Laurence Kotlikoff is running for president himself – as a write in candidate. The Goodman Institute does not endorse political candidates for office and does not participate in political campaigns.

Numerical Results for 2020

Capital 21 percent higher

Output 6 percent higher

Low skill wages 7 percent higher

High skill wages 8 percent higher

$1.338 trillion additional output every year.

###

Media Contact:

Waylon Tate

J. Waylon & Associates, LLC

O: 214-613-0073 | M: 214-763-3910

0 Comments