Both the Senate and House Republicans have now spoken about their preferred tax reforms. The differences between them are relatively minor.

Both the Senate and House Republicans have now spoken about their preferred tax reforms. The differences between them are relatively minor.

The just-announced Republican tax plan is essentially the House “Better Way” plan proposed in June 2016. The business part of the tax reform transforms our corporate tax into a business cash flow tax (BCFT) by moving to full expensing and restricting interest deductibility.

There’s a shiny new high-rise in Boston. It’s strikingly beautiful, with deep blue glass that reflects the sky. The other day I drove past the new tower and saw the huge sign: “To rent or own, call …”

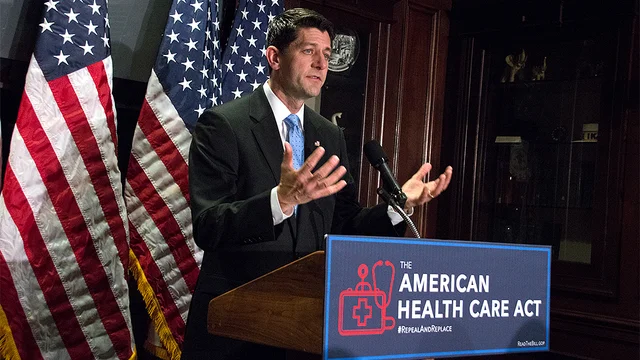

As I’ve written, the House Republican tax bill has a lot to recommend it, including to Democrats. It needs some tweaks and proper transition rules to ensure it’s at least revenue neutral and as progressive as the current system (which, as you can read here, is far more progressive than commonly believed).