Our History

History of the National Center for Policy Analysis

In 1983, the National Center for Policy Analysis (NCPA) established its first offices at the University of Dallas, in a mostly abandoned building. Because of constant leaks in the roof whenever it rained, files had to be removed from the uncarpeted floor and placed on chairs. Unable to raise enough money to meet expenses the first three years, the organization survived because Dr. Goodman waived his salary and paid many of the expenses from his own pocket.

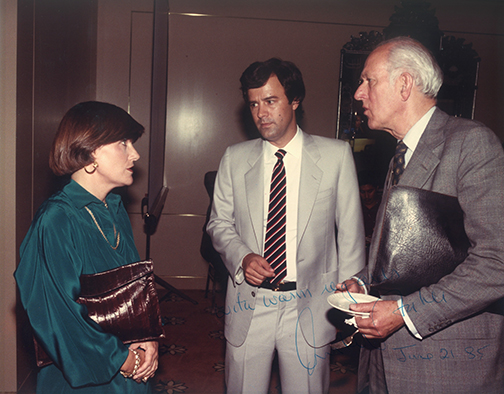

Dr. Goodman founded the NCPA at the urging of Sir Antony Fisher, a British businessman, who had earlier founded the Institute for Economic Affairs in London – an organization that became Margaret Thatcher’s think tank. By the time he died, Sir Antony helped start more than three dozen think tanks in countries around the world. The NCPA’s founding board members included Russell Perry, CEO of Republic Financial Services, Jere Thompson, CEO of the Southland Corporation; Wayne Calloway, CEO of Frito Lay (and later PepsiCo;) and Robert Dedman, CEO of ClubCorp.

Even though the organization had a marquee board, it began with a pauper’s budget.

Early Successes

Small, underfunded and understaffed, this young think tank nonetheless quickly gained national attention, with the motto, “Making Ideas Change the World.”

-

A 1983 study discovered that newborn black males, having a life expectancy of only 65 years, could expect to pay Social Security taxes over their entire working lives and die two years before qualifying for full benefits. The study was covered by Dan Rather on CBS News and appeared on the front page of countless newspapers across the country.

-

Another study summarized in The Wall Street Journal discovered that school districts receive revenue from state governments based on average daily attendance — not on student performance. In response to these incentives, the percentage of fifth graders who finished high school increased by 47 percent over three decades while student test scores plummeted.

-

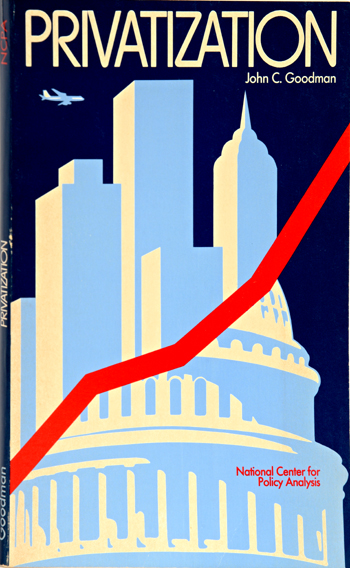

The 1984 NCPA book, Dismantling the State, described Margaret Thatcher’s 22 techniques of privatization. The publication became a privatization handbook, used extensively in the 1980s at the local level in the United States and in countries throughout the world.

-

A follow up publication, Privatization, described the results of a Washington, DC conference at which the NCPA and the Adam Smith Institute of London presented the techniques of privatization to the American public policy community.

- Over the next two decades these two books sparked a privatization revolution at the local level in the United States.

- Also in 1984, John Goodman and Richard Rahn (then chief economist for the U.S. Chamber of Commerce) published an article in The Wall Street Journal on an idea they called “Medical IRAs.” A decade later, Medical Savings Accounts (MSAs) became a reality for thousands of Americans through a six year pilot program. Two decades later, Health Savings Accounts (HSAs) became a possibility for the whole of the non-elderly population.

-

A 1985 study by Dartmouth Professor Dennis Logue found that employees can lose from one-half to two-thirds of their pension benefits by simply changing jobs — even if employees are fully vested in every job. The study recommended personal and portable employee benefits.

-

In 1986, the NCPA developed one of the most innovative policy proposals in its history: taxpayer choice. Rather than allowing the government to collect billions in taxes each year for means-tested benefits, the NCPA proposed to let taxpayers choose how their tax dollars are spent. This concept of “compulsory tithing” was endorsed by Newt Gingrich and other Congressional leaders and was incorporated in several Congressional bills.

-

A 1987 NCPA study was one of the first to estimate the expected taxes and benefits of Social Security for workers in America. The study found that seniors at the time received four to five times more in Social Security benefits than they paid in taxes. Yet people entering the labor force were going to pay tens of thousands of dollars more in taxes than they would receive in benefits when they retire.

-

In another 1987 NCPA study, home-based work expert Joanne Pratt documented the incredible extent to which local ordinances and other laws discourage people — two-thirds of whom are women — from operating home-based businesses. The study received more than 10,000 column inches of print media coverage.

-

A 1989 study generated considerable nationwide media attention. The study found that IRAs and other tax-deferred savings have become less valuable for many middle-class taxpayers because of the Social Security benefit tax.

Repeal of a Law

Also in 1989, a series of NCPA studies of taxes on the elderly led to the repeal of the Medicare Catastrophic Coverage Act, the first repeal of a major federal welfare program in more than 100 years. Nobel Laureate Milton Friedman, the editors of The Wall Street Journal and many others credited NCPA studies and its communications efforts as the primary reasons for the policy reversal.

At this time, the NCPA’s budget was less than $1 million, and the organization had no Washington, DC office. More established organizations began to recognize that the small organization was having a noticeable impact on national policy. The Heritage Foundation called the NCPA “the new ideas think tank.” In a widely distributed memo, “How to Change a Law,” Dr. Goodman identified many of the principles guiding the NCPA’s successful strategy.

MILTON FRIEDMAN GAVE US CREDIT FOR THE REPEAL OF THE LAW.

Taxes

Very few think tank studies are released by members of Congress. The NCPA’s first pro-growth tax cut study was released on Capitol Hill by more than 50 members of the House of Representatives. This was the first of many such events for the NCPA.

-

In 1991, the NCPA and the U.S. Chamber of Commerce published “Strategy for Growth,” calling for five pro-growth tax cuts: a capital gains tax cut, a back-ended (Roth) IRA, an increase in the amount seniors can earn without losing Social Security benefits, a rollback in the Social Security benefits tax and depreciation indexing. This tax package became the basis for a DeLay-Wallop bill, a Gramm-Gingrich bill and several other proposals in Congress. Eventually, the package became the core of the pro-growth tax proposals in the Contract with America. By 1997, three of the proposals became law.

-

The NCPA also began preparing formal forecasts concerning the economic consequences of major proposals. For example, the NCPA found that former California Gov. Jerry Brown’s 1992 flat tax proposal would stimulate the economy more than the economic proposals of two other presidential candidates: George Bush and Bill Clinton.

-

In 1994, SMU economist Gerald Scully estimated a Laffer curve for the United States economy. He found that maximum economic growth occurs when the government takes no more than 23 percent of the GDP. Had taxes been this low since the 1950s, per capita income would be double what it is today. Furthermore, the government would have received enough additional revenue to fund all actual spending programs enacted over the period with no net public debt.

-

In the early 21st century, two studies by Boston University economist Laurence Kotlikoff exposed the perverse incentives built into our tax-welfare system. “Does It Pay to Work?” showed that marginal tax rates exceed 50 percent at almost every income level. “Does it Pay both Spouses to Work?” showed that second earner spouses in two-earner families face the highest marginal tax rates in the country — sometimes in excess of 100 percent!

-

In 2007, members of Congress turned to the NCPA study “Wealth, Mobility, Inheritance and the Estate Tax” in an effort to abolish the estate tax.

-

The NCPA also released “Taxing the Poor,” an examination of the regressive taxes at the federal, state and local levels

An NCPA sponsored, two-hour Firing Line debate on the Flat Tax introduced that idea for the first time to a national television audience. Arguing for the tax reform, Dr. Goodman, Gov.du Pont, William F. Buckley and current California governor Gov. Jerry Brown debated George McGovern, Lester Thurow, etc.

A version of the idea, the “progressive flat tax,” was proposed by Dr. Goodman and Prof. Kotlikoff in 2005. They showed that such a tax is more progressive than the current system.

Education

The NCPA became the first public policy institute to publish a report card on public schools based on results of student achievement exams. The NCPA also pioneered the concept of education tax credits — as an innovative alternative to a spending (voucher) system — to promote competition and choice. A task force report on school choice helped launch the private school voucher movement in the United States.

-

An NCPA study found that teacher salary is based on seniority and achievement of advanced degrees, not on successes in teaching students. In response to these incentives, the percentage of teachers with master’s degrees increased by 83 percent over the past three decades while student test scores took a drastic downturn.

-

Another NCPA study found that Texas’ public schools wasted one of every three resource dollars, and teachers in these schools spent more time complying with red tape than preparing lessons.

-

Based on an NCPA task force report recommending school choice, NCPA board member Pat Rooney started a private school voucher program in Indianapolis for low-income families — a model that spread to more than 30 cities within a decade.

-

In 2001, the NCPA and Children First America published An Education Agenda: Let Parents Choose Their Children’s School, which provided policy-makers with a roadmap for comprehensive reform. A follow-up book, Ten Myths about School Choice, exposed the inaccuracies and distortions opponents use in campaigns against tax-funded school vouchers.

-

The NCPA published a first-of-its-kind report card on public school performance in 1990, finding huge variations in test scores with no relation between spending per pupil and educational outcomes. A revised version of the report card in 2003 found that the best and worst schools are often found in the same neighborhoods. Also, schools may be more capable of teaching one population of students over another.

-

An NCPA sponsored Firing Line debate on school choice introduced the concept to a national audience for the first time.

Health

Among all public policy institutes, the NCPA has uniquely focused on private alternatives to government regulation and control of health care throughout its history. Milton Friedman, The Wall Street Journal and many others credited NCPA research and NCPA communications as the main reasons why Congress repealed the Medicare Catastrophic Care Act of 1989 — the first repeal of a federal welfare program in 100 years. Sen. Phil Gramm and other congressional leaders acknowledge the NCPA’s educational role in the defeat of the Clinton administration’s first-term plan for a national health care system.

The NCPA developed the concept of Medical Savings Accounts and later helped launch the idea in South Africa, where MSA plans captured two-thirds of the market for private health insurance within a decade. The NCPA’s greatest public policy accomplishment was a 2003 law that makes Health Saving Accounts available to all Americans who are not in a government health care plan.

-

Also in 1984, John Goodman and Richard Rahn (then chief economist for the U.S. Chamber of Commerce) published an article in The Wall Street Journal on an idea they called “Medical IRAs.” A decade later, Medical Savings Accounts (MSAs) became a reality for thousands of Americans through a six year pilot program. Two decades later, Health Savings Accounts (HSAs) became a possibility for the whole of the non-elderly population.

-

A 1985 study by Dartmouth Professor Dennis Logue found that employees can lose from one-half to two-thirds of their pension benefits by simply changing jobs — even if employees are fully vested in every job. The study recommended personal and portable employee benefits.

-

In 1986, the NCPA developed one of the most innovative policy proposals in its history: taxpayer choice. Rather than allowing the government to collect billions in taxes each year for means-tested benefits, the NCPA proposed to let taxpayers choose how their tax dollars are spent. This concept of “compulsory tithing” was endorsed by Newt Gingrich and other Congressional leaders and was incorporated in several Congressional bills.

-

A 1987 NCPA study was one of the first to estimate the expected taxes and benefits of Social Security for workers in America. The study found that seniors at the time received four to five times more in Social Security benefits than they paid in taxes. Yet people entering the labor force were going to pay tens of thousands of dollars more in taxes than they would receive in benefits when they retire.

-

In another 1987 NCPA study, home-based work expert Joanne Pratt documented the incredible extent to which local ordinances and other laws discourage people — two-thirds of whom are women — from operating home-based businesses. The study received more than 10,000 column inches of print media coverage.

-

A 1989 study generated considerable nationwide media attention. The study found that IRAs and other tax-deferred savings have become less valuable for many middle-class taxpayers because of the Social Security benefit tax.

Social Security

In 1980, Dr. Goodman authored the first published study on privatized Social Security, an American Enterprise Institute monograph on Britain’s system, which allows employers to contract their workers out of the second tier of the state pension scheme. As the 20th century drew to a close, governments all over the world were looking for similar privatization opportunities.

-

In 1987, the NCPA produced a study documenting the future financial nightmare of the Social Security and Medicare systems. The forecast predicted both programs will consume one-half to two-thirds of workers’ incomes by the time today’s 20-year-olds retire.

-

In 1988, the NCPA published the first international survey of private alternatives to Social Security in 30 countries by World Bank economist Estelle James, including case studies of pension reform in Great Britain, Chile and Singapore.

-

In 1995, the NCPA published an analysis of Singapore’s system of mandatory private retirement savings and individual medisave accounts. The conclusion: Singapore’s approach was significantly more effective and efficient than the welfare state approaches of the United States and Europe.

-

Beginning in the 1990s, the NCPA supported the development of economic models of Social Security and Medicare under the direction of Thomas Saving (a Trustee of the Social Security and Medicare Trust Funds) and his colleagues at Texas A & M University. The model enabled President Bush’s Social Security reform commission to examine alternative proposals for reform.

-

The NCPA used the model to develop the most advanced interactive Social Security calculator on the Internet. The NCPA’s prediction of Social Security benefits was as much as 30 percent more accurate than other calculators, including the one used by the Social Security Administration.

-

In 2003, the NCPA formed a three-year partnership with the National Black Chamber of Commerce (NBCC) to bring the message of Social Security reform to 10 million African Americans through a volunteer network called Team NCPA. The effort grew in membership at a rate of 500 per month.

-

Privatization of Social Security is usually thought to require a workable annuities market. In 2004, Dr. James showed that Chile has the most extensive annuities market in the world and that it is a market that works and works well.

-

In 2005, the NCPA unveiled a new Social Security reform plan developed by Prof. Saving and Andrew Rettenmaier. The conclusion: Social Security’s woes can be completely solved with a 5 percent annual contribution to personal retirement accounts, progressively indexed benefits and a raised retirement age.

-

Also in 2005, the NCPA launched a special project to educate the public about the need for Social Security reform and the benefits of personal retirement accounts. The NCPA held more than 100 events and generated media coverage that had an advertising equivalency of over $1.6 million.

-

In 2006, the NCPA and Brookings Institution collaborated to reform the 401(k) law – principally through the efforts of Peter Orszag (who would later become president Obama’s chief economic advisor), Dr. Goodman and Gov. du Pont. The resulting pension reform bill allows employers to automatically enroll their employees in 401(k) and 403(b) plans with diversified portfolios.

Other Entitlements

The principal reason for the growth of government in the 20th century was social insurance. As family ties dissolved, people turned to government for protection against risks that were difficult to insure against in the private marketplace. For this reason the NCPA devoted more attention to social insurance than any other think tank. In addition to health care and Social Security:

-

A 1984 study by University of Texas at Dallas professor Edward Harpham showed that our private pension system needs radical reform. It has large unfunded liabilities, gives perverse incentives to employers and inadequately protects the workers.

-

Two decades later, Dr. Goodman, Peter Orszag (Brookings Institution) and Gov. du Pont united to successfully reform the country’s 401(k) system by means of the pension reform bill of 2006.

-

In a 2007 study, Dr. Estelle James showed that Chile’s system of privatized disability costs half as much as the public programs in the United States and Europe.

-

In a 2005 study, Bill Conerly drew on Chile’s largely privatized approach to unemployment insurance to show that workers can have better protection at lower cost.

-

In a 2006 study, Michael Helvacian showed that privatized workers compensation has the potential to lower costs and improve employee well being.

Crime and Punishment

A series of NCPA studies showed that crime pays, imprisonment works and private-sector solutions can help reduce crime.

-

A 1992 study by Texas A & M professor Morgan Reynolds showed that a murderer can expect to spend only 2.3 years in prison, a rapist 3.5 months and an auto thief 6.3 days.

-

A 1999 NCPA study released on Capitol Hill showed the downward trend in the U.S. crime rate in the last decade is directly related to an increased likelihood of retention in prison.This study was covered by ABC Nightly News and received other national publicity. In response, the NCPA produced an annual update for several years.

-

A 1992 NCPA study, Myths of Gun Control, showed no relationship between guns and crime. Despite the national concern over assault weapons, there are 250,000 machine guns in private hands in the United States and none of these legally owned weapons have been used during the commission of a crime in the past 50 years.

-

A 1994 study found that three private law enforcement officers exist for every one public officer. The study recommended numerous ways for the private sector to help deter crime, including private attorneys serving as deputy DAs, rewards and bounties for apprehending criminals, privatization of the parole system (similar to the bail bond system) and factories behind bars in privatized prisons.

-

In another widely-quoted NCPA study, University of Utah law professor Paul Cassell found that if the Miranda Rule had not taken effect, police would have solved as many as 20 percent more violent crimes and as many as 16 percent more property crimes. Cassell won a federal appeals panel decision in 1999 overturning the Miranda Rule in one jurisdiction, but the Miranda Rule was subsequently upheld by the Supreme Court.

-

A 2001 study advocated “Factories Behind Bars,” arguing that prisoners should not have to give up their right to work simply because they are in prison.

Environment

The NCPA published two environmental studies in the 1980s. Both received so much national attention that the organization was once again propelled into a leadership role.

-

A 1986 study by John Baden, chairman of the Foundation for Research on Economics and the Environment (FREE), documented the many ways in which the federal government mismanaged the nation’s natural resources, including Yellowstone National Park.

-

A study by Richard Stroup and Dr. Goodman showed that Americans are surrounded by trivial cancer risks — one of every two chemicals produced cancer in rodents when administered at high dosages. The scholars recommended focusing on the fewer serious risks rather than the thousands of trivial risks. The study received more than 15,000 column inches of newspaper coverage.

-

In 1991, the NCPA assembled a 76-member task force representing think tanks and policy organizations on four continents. Their goal was to develop a pro-human, pro-science, pro-free enterprise approach to the environment. The published result, Progressive Environmentalism, was translated into Spanish for use throughout Latin America and into Portuguese for use at the Earth Summit in Rio in 1992.

-

Many credit Lynn Scarlett’s 1991 study, A Consumer’s Guide to Environmental Myths and Realities, with turning around the debate on solid waste issues in the United States. Reader’s Digest published a condensed version. Scarlett subsequently became Deputy Secretary of the Interior in the George W. Bush administration.

-

In 1997, the NCPA produced Lynn Scarlett’s New Environmentalism, a blueprint for a pro-free enterprise approach to environmental policies. The publication laid out the philosophy that was in part followed by the Bush Administration.

-

In 2003, a national communications effort, NCPA’s E-Team, was organized by Sterling Burnett. It reached out to millions of Americans. Adjunct scholars throughout the country worked with E-Team to correct media misinformation on topics concerning the environment and energy.

-

In 2005, the NCPA E-Team project released two major reports. “Living with Global Warming” showed that adopting public policies to adapt to warmer temperatures rather than trying to prevent them are not only less costly, but also more socially beneficial. “The Physical Evidence of Earth’s Unstoppable 1,500-Year Climate Cycle” discussed the negligible impact of humans on climate change.

-

In 2007, the NCPA unveiled its Global Warming Primer — a common sense review of current scientific evidence. (See the 2013 update with Sterling Burnett’s video explanation here.)

-

In 2008, the NCPA released “Global Warming: Experts’ Opinions versus Scientific Forecasts.” The study critiqued the forecasting techniques used in many global warming predictions.

The Women in the Economy

The Woman in the Economy (WIE) Program was established in 2001 and was designed to communicate the benefits of empowering individuals and relying on free markets. Among the publications:

-

Women’s Agenda: Necessary Public Policy Reforms, a book that took a critical look at the institutions and public policy issues that most affect women, including taxes, Social Security, welfare, retirement and health care.

-

Published in 2012, Leaving Women Behind: Modern Families, Outdated Laws by Kimberley A. Strassel, Celeste Colgan, and Dr. Goodman showed how public policy institutions have not kept pace with social changes. Instead, current laws reward families with a full-time worker and a stay-at-home spouse and punish other arrangements.

Welfare

Following the Republican takeover of Congress in 1994, interest in welfare reform soared. Congress passed President Clinton’s proposal to end the Aid to Families of Dependent Children (AFDC) program and send the money back to the states. This prompted NCPA researchers to discover working solutions at the state level.

-

In 1996, Dr. Goodman, along with Nobel Laureate Gary Becker and a small group of distinguished Americans, were invited to meet with Pope John Paul II and attend a Vatican conference on re-examining the church’s position on welfare and the family.

-

Also in 1996, an NCPA analysis found that an Oregon program subsidizing private sector jobs held the greatest promise for moving people from welfare to work.

-

A 1997 report card ranked the states on the basis of success in welfare reform, finding that Wyoming reduced its welfare rolls by 73 percent, while in Hawaii the number of recipients increased by 36 percent.

-

An NCPA 1997 report card on foster care found that North Dakota placed 97 percent of eligible children for adoption, while Hawaii placed less than 10 percent.

-

Newt Gingrich, Bob Dole and many others endorsed the NCPA’s more radical idea of allowing taxpayers to allocate their own welfare tax dollars to qualified charities rather than to the federal government. (See John Goodman and Michael Stroup, Privatizing the Welfare State.) A version of the idea was included in President Bush’s proposal to encourage faith-based charities.

-

A 2002 study by former Congressional Budget Office Director June O’Neill found that welfare reform accounted for more than half of the decline in welfare participation since 1996 and more than 60 percent of the rise in employment among single mothers. The states with the greatest declines in welfare use were those that emphasized “work first,” rather than training or further education.

-

In 2011, the NCPA released a task force report on enterprise programs showing that government regulations are blocking many private sector options that could provide essential services to the poor, including transportation, child care, security, housing and health care.

-

Also in 1984, John Goodman and Richard Rahn (then chief economist for the U.S. Chamber of Commerce) published an article in The Wall Street Journal on an idea they called “Medical IRAs.” A decade later, Medical Savings Accounts (MSAs) became a reality for thousands of Americans through a six year pilot program. Two decades later, Health Savings Accounts (HSAs) became a possibility for the whole of the non-elderly population.

-

A 1985 study by Dartmouth Professor Dennis Logue found that employees can lose from one-half to two-thirds of their pension benefits by simply changing jobs — even if employees are fully vested in every job. The study recommended personal and portable employee benefits.

-

In 1986, the NCPA developed one of the most innovative policy proposals in its history: taxpayer choice. Rather than allowing the government to collect billions in taxes each year for means-tested benefits, the NCPA proposed to let taxpayers choose how their tax dollars are spent. This concept of “compulsory tithing” was endorsed by Newt Gingrich and other Congressional leaders and was incorporated in several Congressional bills.

-

A 1987 NCPA study was one of the first to estimate the expected taxes and benefits of Social Security for workers in America. The study found that seniors at the time received four to five times more in Social Security benefits than they paid in taxes. Yet people entering the labor force were going to pay tens of thousands of dollars more in taxes than they would receive in benefits when they retire.

-

In another 1987 NCPA study, home-based work expert Joanne Pratt documented the incredible extent to which local ordinances and other laws discourage people — two-thirds of whom are women — from operating home-based businesses. The study received more than 10,000 column inches of print media coverage.

-

A 1989 study generated considerable nationwide media attention. The study found that IRAs and other tax-deferred savings have become less valuable for many middle-class taxpayers because of the Social Security benefit tax.

In 1994, an NCPA sponsored Firing Line debate on Health Savings Accounts introduced the idea to a national audience and pitted Dr. Goodman, Gov. du Pont and Sen. Phil Gramm against Sen. Jay Rockefeller, Rep. Pete Stark, etc.

Avoiding Recessions

Robert McTeer, the former president of the Federal Reserve Bank of Dallas, for many years represented the NCPA on TV and radio financial talk shows, in newspaper editorials and at his blog. In addition:

-

By means of a briefing for congressional aides, the NCPA was the first think tank to introduce “market monetarism” to Capitol Hill. The economists who presented, Scott Sumners and David Beckworth, are increasingly thought to be the intellectual heirs of Milton Friedman’s monetarism.

-

In a seminal article in the New Republic, Prof. Kotlikoff and Dr. Goodman proposed a radical reform of the banking system – one that would end the borrow-short, lend-long approach that inherently subjects the credit market to the risk of financial panics.

International

A major stimulus in the foundation of the NCPA was the support of founding board member Sir Antony Fisher who, through the Atlas Foundation, helped establish more than three dozen think tanks around the world. Working through the Atlas Foundation’s international network, NCPA personnel conducted annual seminars on such subjects as budgeting and cash flow management for developing think tanks. The following are a few NCPA studies which were especially useful to policymakers and think tanks in other countries:

-

Dr. Goodman and Ramona Marotz-Baden authored Fighting the War of Ideas in Latin America in 1991, at a time when most Latin American countries were liberalizing their economies. It included chapters by Hernando de Soto (Peru), Alberto Benegas Lynch Jr. (Argentina) and Luis Pazos (Mexico).

-

Gerald Scully estimated an international Laffer Curve in 1991, finding that countries maximize tax revenues at 43 percent of the GDP but maximize economic growth when taking no more than 19 percent.

-

A 1995 international study by Scully found that countries with more political and civil liberty have higher rates of economic growth. He also discovered that culture has a significant effect on economy: non-Muslim countries are more liberated than Muslim countries, common law countries are freer than civil law countries and countries with an independent judiciary are emancipated more so than those without.

-

A 1997 study by Scully found that the world is becoming more peaceful because governments are finding more value in productive citizens; countries that dispose of significant numbers of their own citizens sacrifice, on average, a fifth of the country’s potential GDP.

-

In 2001, an NCPA study, “Waging the New War on Terrorism,” argued that in addition to military action to win this war, the U.S. must delegitimize hostile regimes and effectively use economic measures against terrorist organizations and their support networks.

-

Another 2001 study, “Crisis Policy-Making: Immediate Action, Prolonged Regret,” showed that wars and crises often are excuses for unjustified increases in the size and power of government.

-

In 2005, the NCPA published Czech Republic President Václav Klaus’s book On the Road to Democracy about free-market reforms and the lessons learned during the transition from Soviet domination to democracy. The book was praised by Nobel Prize winning economists Gary Becker and Milton Friedman.

Public Choice

The key to successful public policy innovation is understanding why governments do what they do. This has been a central focus of Dr. Goodman’s academic career and it guided the work of the NCPA for 31 years:

-

Dr. Goodman’s essay on Public Choice is the clearest statement found anywhere on why government policies fail to achieve optimal results.

-

Dr. Goodman and University of South Florida economist Philip Porter produced a technical journal article showing why regulation fails.

-

Dr. Goodman and Prof. Porter also produced a technical journal article showing why government spending programs fail.