- John Goodman

- Larry Kotlikoff

- Jane Shaw Stroup

- Thomas Saving

- Devon Herrick

- Linda Gorman

- Pete Du Pont

- All Posts

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Our Tattered Health Care Safety Net

We are probably as close to universal health insurance as we are ever likely to be. Yet we are doing a poor job of delivering care to families at the bottom of the income ladder. These families find that as their income goes up and down and as their job opportunities ebb and flow, they bounce back and forth among eligibility for Medicaid, eligibility for subsidized insurance in the Obamacare exchanges, eligibility for employer-provided coverage and sometimes eligible for none of the above. More.

ObamaCare Turns Out to Be Affordable Only for the Healthy

It was supposed to help those with pre-existing conditions, but they pay dearly for bad options.

Obamacare’s Dirty Little Secret

When Democrats passed the Affordable Care Act of 2010, President Obama and lawmakers made the same claim over and over: The act would make good, affordable health insurance available to people with pre-existing conditions. The actual result has been the opposite. Obamacare makes health insurance as good as possible for the healthy and as bad as possible for the sick.

From John Goodman’s editorial in the Wall Street Journal (Paid gateway)

Can the Left and Right Agree on Health Reform?

A new book calls for universal health insurance coverage, but with no increase in government spending. It’s getting a lot of attention in progressive circles. Yet a bill that would go a long way toward implementing Finkelstein’s proposal has been introduced in Congress by a conservative Republican. More

Who Are the Real Authoritarians?

If the Trump presidency meant anything, it meant less government. Specifically, lower taxes, less regulation, and fewer (potentially war-causing) foreign entanglements. Typical Trump supporters are also anti-government – even more than Trump is. More

A Republican Alternative to Medicare for All

It’s been 15 years since John McCain ran for president with a plan to completely revamp our healthcare system. In the interim, Republicans have attempted a nip here or a tuck there, but nothing really big. Fortunately, Rep. Pete Sessions (R-TX) and his colleagues have come to the rescue with a reform plan that is a pro-patient, pro-family, pro-free enterprise alternative. It is based on three fundamental values. More

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.

Obamacare Exchanges at Age Ten

March 23rd will mark the 14th anniversary of the Affordable Care Act, and it is now ten years since the creation of the Obamacare exchanges. There are three ways to look at Obamacare today: in terms of (1) what the Obama administration said it was about, (2) what policy wonks thought it was about, and (3) how it really works. More at my post at Forbes.

Social Security COLA Still Fails To Keep Up With Inflation

The COLA is supposed to keep our (I’m also a recipient) benefits even with inflation. Unfortunately, it doesn’t. The COLA is calculated based on the rise in the Consumer Price Index between September 30th and October 1st of the previous year. Hence, we’re getting compensated for past annual inflation, with a three-month lag to boot! This leaves us perpetually behind the eight ball. More

The US is a Waning Economic Superpower

The U.S. is a waning economic hegemon. But far too few Americans, including politicians, realize this. The eventual new and very big kid on the block is, under all but extreme scenarios, China; and, after China, India. By 2100, the U.S. will be in third place, when ranked by GDP — producing only 12 percent of global output compared with China’s 27 percent and India’s 16 percent. More

The Republicans Need Their Own Student Loan Reform. Here It Is.

President Biden just canceled a mother-load of student debt. The income limit for the President's largess is $125,000 for individual borrowers and $250,000 for married and heads of households. Those below these limits received up to $10,000 in debt forgiveness. And...

Finally, A Safe Way To Play The Market — Upside Investing

Upside Investing represents a revolution in investment/spending strategy. It lets you set a living standard floor that only rises as a result of investing in stocks and other risky assets. The higher your floor, the lower your upside and vice versa.

Inequality has been Greatly Exaggerated

A new study by Goodman Institute Senior Fellow Laurence Kotlikoff and his colleagues says that middle-aged families in the top fifth of the income distribution have almost 200 times the wealth of families in the bottom fifth. But after taxes and entitlement transfers, the difference in lifetime spending power is only 7.5 to 1. Our fiscal system is far more progressive than critics like to admit. See the New York Times description and the technical paper.

We’re Not Saving Enough

Americans don’t save enough, either individually or collectively. Yet by looking at the wrong data, many journalists and even top economists are claiming we’re experiencing a “savings glut.” This is hogwash. It’s time to talk turkey about U.S. saving and for journalists and professionals to either do their homework or hold their pens. More

How Congress Can Help Protect Us from Inflation

The inflation rate is the highest it’s been in 40 years. Congress can’t change that. But there are six things it can do to help all of us weather inflation, beginning with full inflation indexing of the tax code.

Could We Talk Ourselves into A Recession?

Congress should take this opportunity to make the tax system fully inflation-neutral. But neither inflation nor the Fed’s minor rate hikes will kill the economy. Nor will Putin’s war, which is stimulating the defense industry. Nor will ongoing slowdowns in Chinese production, which is stimulating home production. What can kill the economy is enough people, who should know better, talking it down.

America’s Fiscal Gap

That’s the difference between the federal government’s spending commitments and its income – looking indefinitely into the future. Closing the gap through time requires an immediate and permanent 41.3 percent increase in all federal taxes or an immediate and permanent 35.3 percent cut in all non interest federal spending. More

Social Security Benefits: Heads They Win, Tails You Lose

One disabled lady was clawed back for over $300,000 for a mistake that Social Security admitted in writing was theirs! If she doesn’t repay, Social Security will almost always stop sending people like her a single penny until they pay “what they owe.” This can take years or decades. More

Social Security Sues invalid for Money He Received 21 Years Ago, At Age 11

Roy Farmer of Grand Rapids Michigan has Cerebral Palsy. He’s 32. In 2019, out of the blue, he received a claw back letter from Social Security demanding he repay $4,902 that his (now deceased) mother received back when he was 11. Roy has spent over three years appealing this judgement. He’s been denied twice. More from Kotlikoff Forbes editorial.

The Case for Retirement Communities

A retirement home has some resemblance to a college dorm. But that’s a good thing. Unlike a typical apartment complex, where one rarely knows one’s neighbors, a retirement home allows meeting many people—at meals, exercise classes, lectures and clubs.

Student Loans: A ‘National Catastrophe’

Review of The Debt Trap: How Student Loans Became a National Catastrophe, by Josh Mitchell (New York: Simon & Schuster, 2021) 261 pp.

Going Against the Grain

In 1973, John Baden and Richard Stroup proposed selling off the U. S. Forest Service to private owners, some nonprofit and some for-profit. In an article in the Journal of Law and Economics, they argued that commercial timber would be better managed by private companies, and non-profit organizations like the Sierra Club could protect the important environmental areas.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

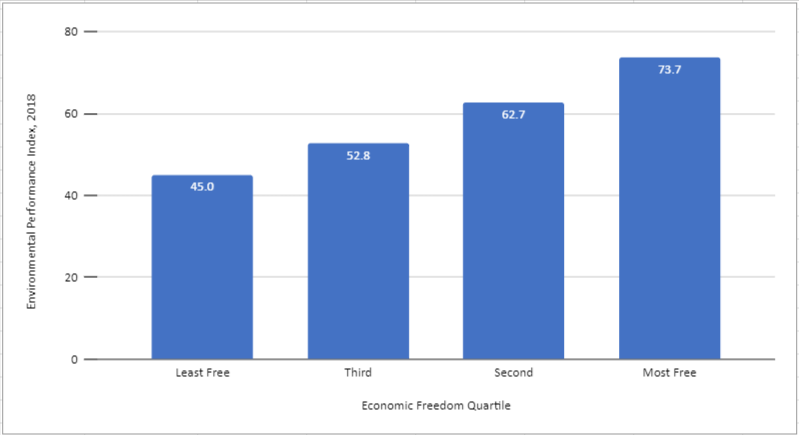

Economic Freedom IS good for the environment

Yes, data from the Yale Center for Environmental Law & Policy and the Fraser Institute’s Economic Freedom of the World Index send a resounding message: Economic freedom brings about environmental protection. Why? Because economic freedom leads to prosperity and only prosperous countries can truly protect their environment. Are you skeptical? More.

Why California Needs Higher Prices for Water

California’s extreme drought will force rationing of water or higher prices, say John McKenzie and Richard McKenzie. Raising water prices has a great advantage: “Higher water prices can increase the state’s available water supply—without additional rainfall or...

Economic Growth Theories Fall into the Dustbin of History (And That’s Okay)

Economists like Samuelson failed to understand economic growth in developing countries. Unbeknownst to them, cost-reducing innovations in transportation and communication led to increased trade and lifted people out of poverty. The Industrial Revolution benefited only a small portion of the world. Trade spurred prosperity and development on its own.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Gramm and Saving in the Wall Street Journal: Fed Task is Precarious

The Fed balance sheet contains 20% of all publicly held federal debt and 34% of the value of all outstanding government-guaranteed mortgage-backed securities. As the economy returns to normal growth, getting rid of those assets risks runaway inflation or a crippled recovery or both.

Saving: Are Republicans Too Stingy with Medicaid?

Before the Senate voted on a “skinny” alternative to Obamacare, it was considering the House version of repeal and replace – called the Better Care Reconciliation Act (BCRA).

Saving and Gramm in the Wall Street Journal: The Fed’s Obama-Era Hangover

The Federal Reserve System is paying banks not to lend money under an Obama era policy.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Herrick: OBAMACARE RATIONS CARE FOR THE SICK AND OVERCHARGES THE HEALTHY

The health care reform debate that lead to Obamacare was initially about covering the uninsured, but in order to gain the support of ordinary people who already had coverage, proponents had to figure out a way to sway public opinion.

Herrick: States Should Ban These Lab Scams

There is a new health care scam spreading across rural America that could cost you plenty. Large commercial labs like Quest Diagnostics and LabCorp do not have locations in every small town. As a result, many rural hospitals perform lab work for both their inpatients and outpatients in the local community.

Correcting Misconceptions of Health Care Reform

One reader posed the question, how does the tax break for employee health insurance harm our health care system? Short answer: over time the practice reduced competition, which weakened cost-control and resulted in health care inflation three times that of consumer inflation. Consider this: once covered by generous health plans, workers cared less about what medical care cost because their health plans paid most of the tab. Employers didn’t care what things cost because they were passing on the costs to workers (indirectly) in lieu of higher cash wages. Third party administrators (TPAs), who manage the benefits for employers, didn’t much care what things cost because they were passing on the costs to employers with a mark-up. The more money spent, the more TPAs earn.

Gorman in The Hill: States are bilking Uncle Sam with Medicaid scams

Congress has decided to stop forcing federal taxpayers to subsidize people who live under state governments intent on levying excessive income taxes. Now, how about ending federal subsidies rewarding states that tax the heck out of health care?

Congress Could Improve Health Care by Reforming the False Claims Act

In a new Independence Institute working paper on the use and misuse of the False Claims Act (FCA), attorneys Mark W. Pearlstein and Laura McLane explain how an 1863 statute written to expose and punish Civil War contractors who billed for gunpowder and supplied kegs full of sawdust raises costs and threatens access to medical care.

Foreign Health Care is No Model for the United States

Repealing ObamaCare would produce better outcomes for patients, those who care for them, and those who pay their bills.

ObamaCare is a success — at sucking vast sums of money from the private sector

In Washington, the healthcare debate isn’t about rescuing the people in the individual insurance market from ObamaCare’s high premiums and poor coverage. Nor is it about improving patient welfare, or reducing medical costs. It’s about using the “coverage for all” mantra to suck huge sums of money out of the private sector with ObamaCare taxes, premiums, and regulations.

Gorman: We can cover those with pre-existing conditions without Obamacare

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others. Properly structured stand-alone high risk pools and medically underwritten individual health policies guaranteed coverage for more than a decade before ObamaCare.

Individual Insurance Buyers Were Better Off Without Obamacare

Obamacare’s destruction of the individual health insurance market has done enormous damage to the lives and finances of millions of people who purchase their own insurance.

ObamaCare has Failed Patients with Pre-Existing Conditions

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others.

ObamaCare has failed patients with pre-existing conditions

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others.

If The Court Strikes Down Obamacare, How Bad Would That Be?

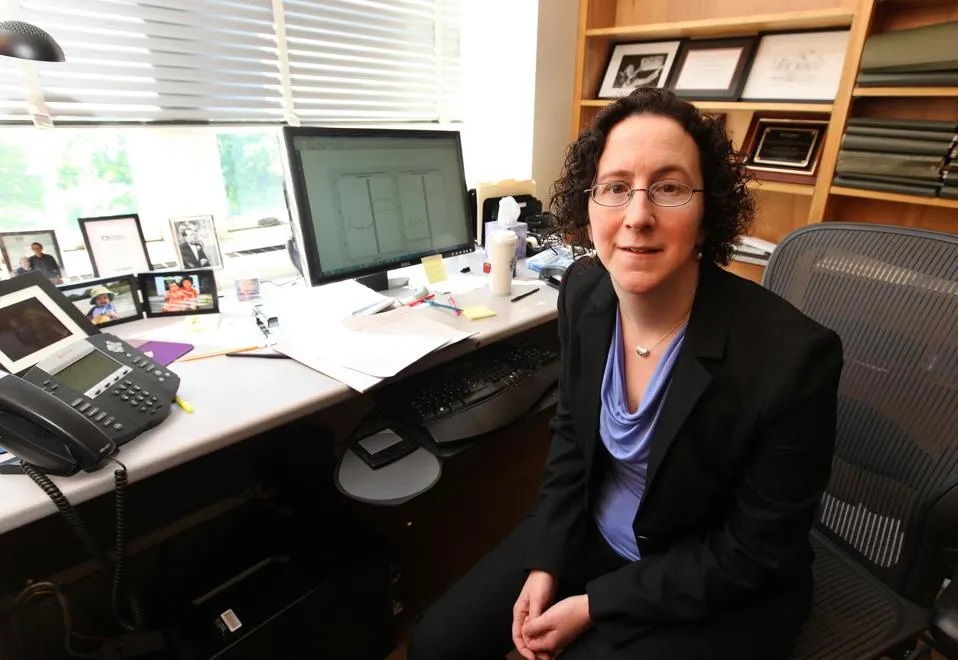

This article was coauthored by Linda Gorman, director of health care at the Independence Institute in Denver, Colorado.

Gorman in The Hill: Trump’s Drug Plan Wrong Rx

The Trump administration wants to use an average of the drug prices paid by other countries to limit what Medicare Part B pays for some drugs. This is a bad idea.

Hidden Traps in the IRA Bill’s Drug Provisions

In the near future, the elderly and the disabled will face a double whammy: higher premiums for Part D drug insurance and higher prices at the pharmacy. This is on top of negotiated prices (and the consequent drop in new drug production) which will kick in later in the decade.

John Goodman and Linda Gorman explain why this will happen in The Hill.

Make Government Less Taxing

Our returns don't have to be this unhappy. Commentary by Pete du Pont April 26, 2013 Source: The Wall Street Journal Americans don't like things that are inefficient, costly or unfair. Our federal tax code seems designed to be all three, a failing exacerbated by a...

Peace Through Strength: Still a Good Idea

Has Obama overcome his foreign policy naiveté? Commentary by Pete du Pont March 29, 2013 Source: The Wall Street Journal The domestic policies of the Obama administration evince a lack of understanding and experience in how an economy functions and grows. Things are...

The Democratic Majority Is Doomed

The entitlement mentality can't survive a weak economy. Commentary by Pete du Pont March 01, 2013 Source: Wall Street Journal Many argue the coalition that elected and re-elected Barack Obama represents a long-term shift in the electorate that will determine...

Big Bird Should Leave the Nest.

Romney was right about public broadcasting. Commentary by Pete du Pont January 31, 2013 Source: Wall Street Journal It's time to end the federal subsidy for public broadcasting. Doing so now would be good for President Obama, Congress and the American taxpayers. And,...

Focus on Fundamentals

The current economic debate is an exercise in missing the point. Commentary by Pete du Pont December 30, 2012 Source: Wall Street Journal "If we're going to raise revenue and if we're going to raise it in any form, then we darn well better cut spending, because...

Hello, Europe

On its current trajectory, America will look like France or Greece before long. Commentary by Pete du Pont November 22, 2012 Source: Wall Street Journal The election is behind us, with President Obama's strong victory over Mitt Romney. Mr. Obama did not do as well...

Will America Abandon ‘Hope’?

As the election approaches, most voters think the country is on the wrong track. Commentary by Pete du Pont July 29, 2012 Source: The Wall Street Journal The presidential campaign remains very close, but some of the polling information must continue to cause alarm in...

Class Struggle

On education, there are big differences between Obama and Romney. Commentary by Pete du Pont June 27, 2012 Source: The Wall Street Journal Much has been written about the choice we face just 19 weeks from now, when we will select the next president. But while we...

Hillary Will Run

How could she not? Commentary by Pete du Pont October 29, 2013 Source: Wall Street Journal Hillary Clinton is going to run for president in 2016. Granted, she is exhibiting even more coyness than most presidential prospects, and yes, the media are filled with those...

The Beltway Stalemate

Democrats and Republicans have never had such a conflict of visions. Commentary by Pete du Pont September 26, 2013 Source: The Wall Street Journal The debate about military action in Syria seems over for now, and Washington is back in campaign mode. We have a...

Global Warming Heats Up

The public could use an honest debate. Commentary by Pete du Pont February 27, 2014 Source: The Wall Street Journal Global warming is back. Not actual global warming, as the decadelong trend of little to no increase in temperatures continues. But the topic of global...

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

A typical doctor’s office is quite spartan. The seating is usually austere. The flooring is low-budget (if there is carpeting, it is probably worn). And there are no free drinks or free food. If there is a restroom, it is probably located somewhere else in the building. More.

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Our Tattered Health Care Safety Net

We are probably as close to universal health insurance as we are ever likely to be. Yet we are doing a poor job of delivering care to families at the bottom of the income ladder. These families find that as their income goes up and down and as their job opportunities ebb and flow, they bounce back and forth among eligibility for Medicaid, eligibility for subsidized insurance in the Obamacare exchanges, eligibility for employer-provided coverage and sometimes eligible for none of the above. More.

Julian Simon, Vindicated Again

Each year, the Competitive Enterprise Institute (CEI) has a dinner in Washington, D.C., honoring the economist Julian Simon, who died in 1998. Simon was a rare optimist in the fields of population and natural resources. He disagreed with most environmentalists of his day (especially in the 1980s through 1990s). They feared passionately that growing population would overwhelm agriculture and industry and that the world would run out of natural resources such as oil and minerals.

What Companies Using AI Need To Know About The Sam Altman Reshuffle

Turmoil is rocking the artificial intelligence industry. Business leaders developing an AI strategy should—in most but not all cases—continue as before the recent big news.

The board of OpenAI fired Sam Altman as CEO on November 17, and the company’s president, Greg Brockman, resigned soon after. Three days later, Microsoft announced, “Sam Altman and Greg Brockman, together with colleagues, will be joining Microsoft MSFT -1.2% to lead a new advanced AI research team.”

Tyler Cowen Searches For Economics GOAT In New Book

GOAT: Who is the Greatest Economist of all Time and Why Does it Matter? is an intriguing book by the well-known economist Tyler Cowen in which he tries to determine who is the greatest economist of all time. This book will be enjoyed not only by economists but also those interested in understanding the world of people and their interactions. Importantly, the book emphasizes the non-financial implications of economic analysis in areas such as friendship, community and aesthetics.

More Important Than the Industrial Revolution

It’s called the Transportation-Communication Revolution. In recent times, shipping costs have fallen by 50 percent and air cargo costs have fallen by almost 100 percent. As a result, the per capita GDP of developing countries (outside of sub-Saharan Africa) between 1960 and 2015 rose a whopping 549 percent.

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

Obamacare Exchanges at Age Ten

March 23rd will mark the 14th anniversary of the Affordable Care Act, and it is now ten years since the creation of the Obamacare exchanges. There are three ways to look at Obamacare today: in terms of (1) what the Obama administration said it was about, (2) what policy wonks thought it was about, and (3) how it really works. More at my post at Forbes.