What’s New

Is There a Trump Health Care Plan?

Although he rarely talks about it, the most significant gift Donald Trump bequeathed to economic prosperity was deregulation. And the one sector that was deregulated more than any other was health care. Since Joe Biden has been re-regulating the economy, it’s hard to think of a starker contrast between the two leading presidential candidates this year – and it affects all aspects of health care. More

Liberalism Explained

In the early 20th century, they called themselves “progressives.” Then, they were “liberals.” Now they are “progressives” again. Early on, they embraced racism and endorsed eugenics. Then they became advocates for civil rights. Now they endorse racism of a different sort – wokeness. If you had to the describe the distinguishing characteristic of modern liberalism, what would your answer be? John Goodman gives a novel answer. More

Social Security Reform, Part II

To get seniors to support Social Security reform, there are additional abuses that need correcting. These include: stopping the double taxation of senior income through the Social Security benefits tax, no longer forcing seniors to dissave, abolishing the Social Security earnings penalty, and ending taxation by inflation. More

Obamacare Exchanges at Age Ten

March 23rd will mark the 14th anniversary of the Affordable Care Act, and it is now ten years since the creation of the Obamacare exchanges. There are three ways to look at Obamacare today: in terms of (1) what the Obama administration said it was about, (2) what policy wonks thought it was about, and (3) how it really works. More at my post at Forbes.

Thomas Saving, RIP (1934 – 2024)

Tom Saving and I were friends and colleagues for many years. We produced studies together. We wrote editorials for the Wall Street Journal and other publications. We published scholarly articles in such publications as Health Affairs and the Journal of Business Economics. We conducted numerous briefings for members of Congress and their staff.

How to Reform Social Security

The key to reform is to make today’s retirees positive beneficiaries of reform.

A golden opportunity to do so exists for two reasons: (1) the current system is abusing senior retirees in myriad ways, and (2) many of these abuses can be eliminated without any cost to the Treasury. In other words, some aspects of responsible reform are a free lunch.

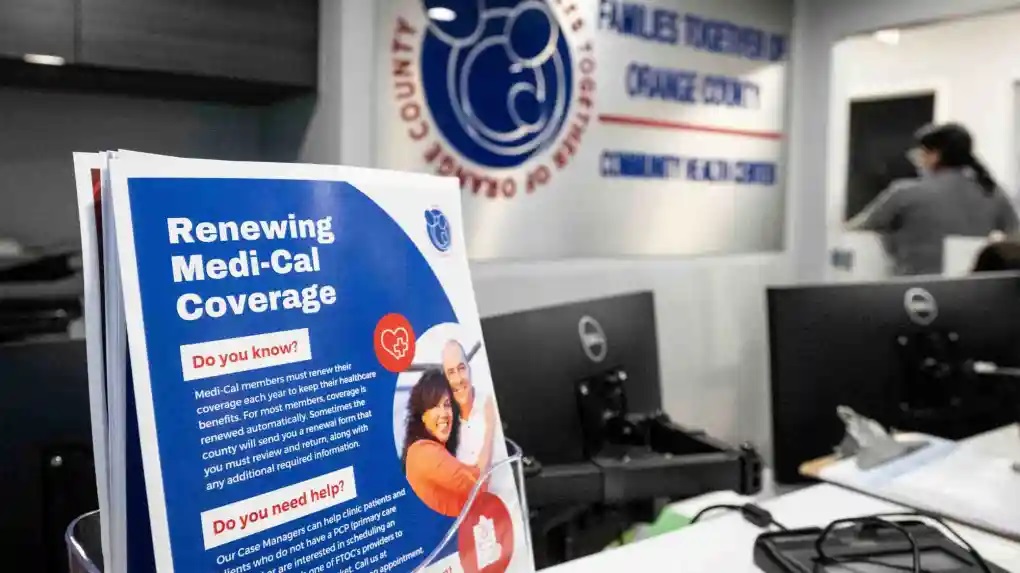

California Dreaming

California legislators want the state to provide free health care to every resident, including undocumented immigrants. Under the act, it would be illegal for any resident to pay a doctor privately for any medical treatment covered by CalCare. John Goodman and Linda Gorman predict higher taxes, less choice, an exodus of doctors and nurses out of the state, rationing by waiting, and something actually worse than Medicaid for all. See our editorial in the Orange County Register.

More Important Than the Industrial Revolution

It’s called the Transportation-Communication Revolution. In recent times, shipping costs have fallen by 50 percent and air cargo costs have fallen by almost 100 percent. As a result, the per capita GDP of developing countries (outside of sub-Saharan Africa) between 1960 and 2015 rose a whopping 549 percent.

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.